Question: You have decided that in order to have a comfortable retirement you will need to replace $65,000 in income each year in retirement. Assuming you

You have decided that in order to have a comfortable retirement you will need to replace $65,000 in income each year in retirement. Assuming you will need 20 years of retirement income and an inflation rate of 3.5%, how much will you need to have saved up in order to meet your goal on the day you retire?

show the step and which formula is used

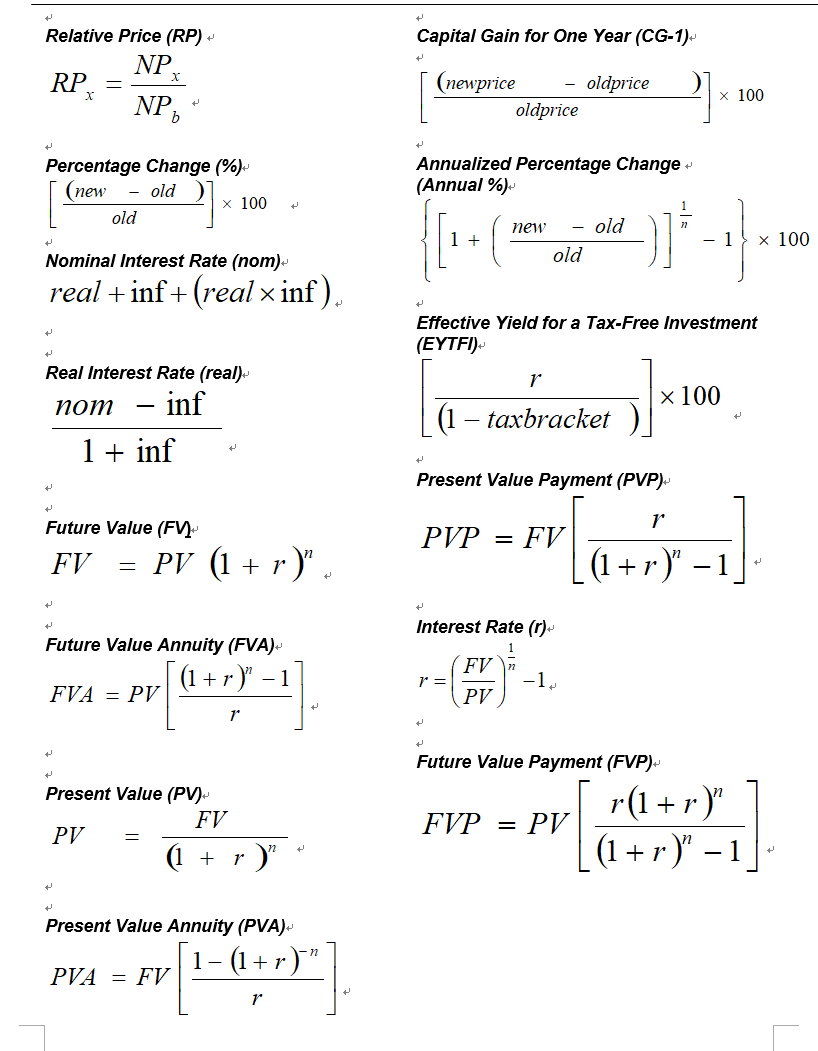

+ Capital Gain for One Year (CG-1)- Relative Price (RP) NP RP = (newprice oldprice oldprice 100 NP + Percentage Change (%) (new - old x 100 old Annualized Percentage Change (Annual %) t new old -1] -1 x 100 Nominal Interest Rate (nom). old real +inf + (real x inf). Effective Yield for a Tax-Free Investment (EYTFI). 1 Real Interest Rate (real). nom inf x 100 (1 taxbracket 1 + inf + Present Value Payment (PVP)- 1 Future Value (FV)- FV PVP FV = PV (1 + r r). (1 +r) 1 Interest Rate (r)- 1 Future Value Annuity (FVA) (1+r)" - 1 FVA = PV 1 = FV PV -1 t Future Value Payment (FVP- Present Value (PV) FV PV (1 + r ) r(1+r)" FVP = PV (1 + r)" 1 = t Present Value Annuity (PVA)- 1- (1+r)" PVA = FV fr [1-677)"] + + Capital Gain for One Year (CG-1)- Relative Price (RP) NP RP = (newprice oldprice oldprice 100 NP + Percentage Change (%) (new - old x 100 old Annualized Percentage Change (Annual %) t new old -1] -1 x 100 Nominal Interest Rate (nom). old real +inf + (real x inf). Effective Yield for a Tax-Free Investment (EYTFI). 1 Real Interest Rate (real). nom inf x 100 (1 taxbracket 1 + inf + Present Value Payment (PVP)- 1 Future Value (FV)- FV PVP FV = PV (1 + r r). (1 +r) 1 Interest Rate (r)- 1 Future Value Annuity (FVA) (1+r)" - 1 FVA = PV 1 = FV PV -1 t Future Value Payment (FVP- Present Value (PV) FV PV (1 + r ) r(1+r)" FVP = PV (1 + r)" 1 = t Present Value Annuity (PVA)- 1- (1+r)" PVA = FV fr [1-677)"] +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts