Question: You have decided to use the same going-in cap rate as the terminal cap rate at the end of Year 5, without adding a risk

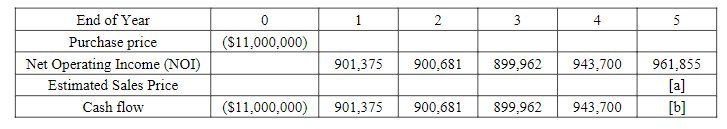

You have decided to use the same going-in cap rate as the terminal cap rate at the end of Year 5, without adding a risk premium.

1. What is the terminal cap rate and estimated sale price for Year 5 in [a] of the table?

2. What value do you project the value in [b] of the table? It is recommended that you refrain from rounding off until you complete your calculations.

3. The value in [b]:

4. What is the internal rate of return (IRR) for this investment?

5. Compute the net present value (NPV) using a required return rate of 9%. Based on this analysis, is this investment option a good choice for you? Why or why not? NPV: Would this be a good investment option for you?: Yes/No Reasons:

Please note that we will not be computing IRR using monthly cash flows; instead, for simplicity in Q6, we will directly use the annual summary in the table. Please note that we will not be computing NPV using monthly cash flows; instead, for simplicity in Q6, we will directly use the annual summary in the table.

\begin{tabular}{|c|c|c|c|c|c|c|} \hline End of Year & 0 & 1 & 2 & 3 & 4 & 5 \\ \hline Purchase price & ($11,000,000) & & & & & \\ \hline Net Operating Income (NOI) & & 901,375 & 900,681 & 899,962 & 943,700 & 961,855 \\ \hline Estimated Sales Price & & & & & & {[a]} \\ \hline Cash flow & ($11,000,000) & 901,375 & 900,681 & 899,962 & 943,700 & {[b]} \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts