Question: You have determined that you will need at least 3 000 000 SEK in private pension savings when you retire in 45 years. You plan

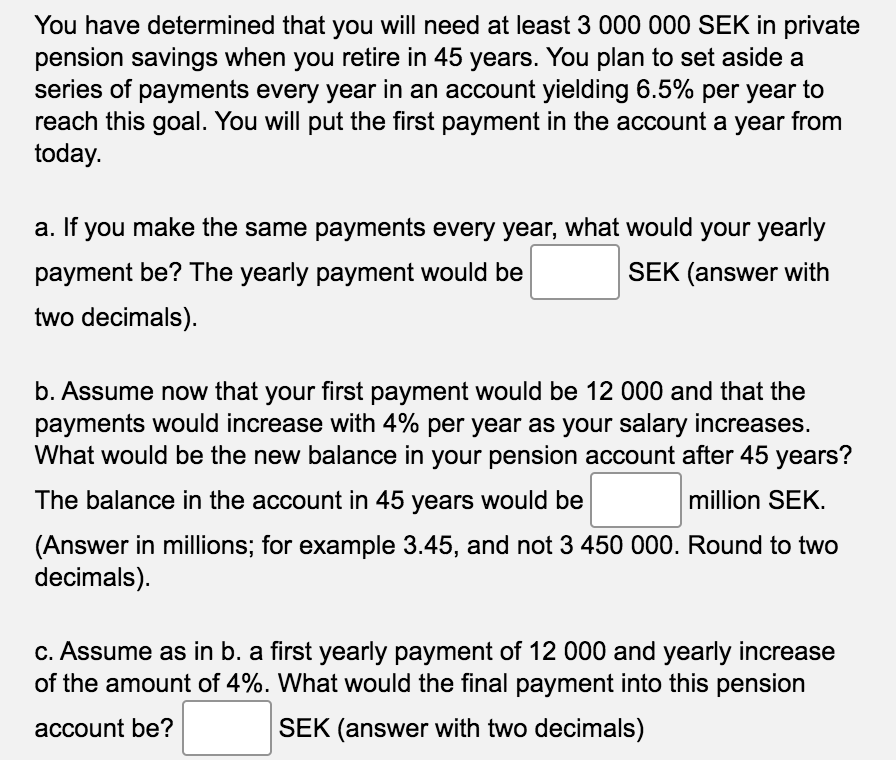

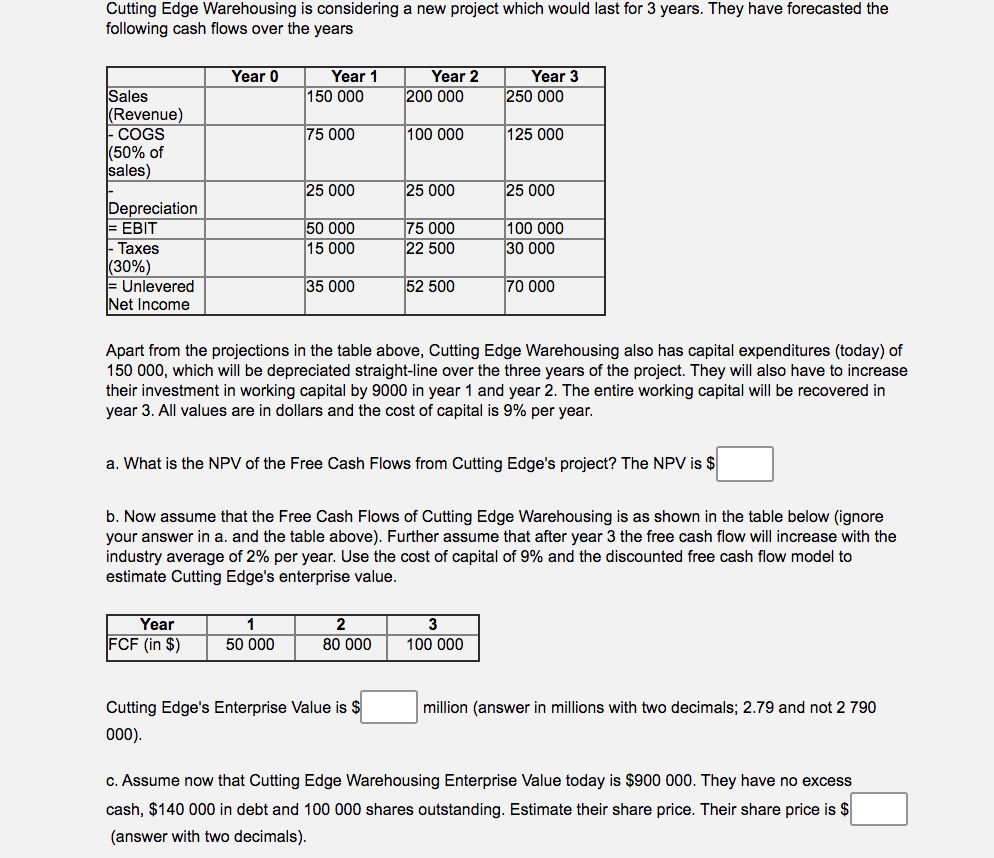

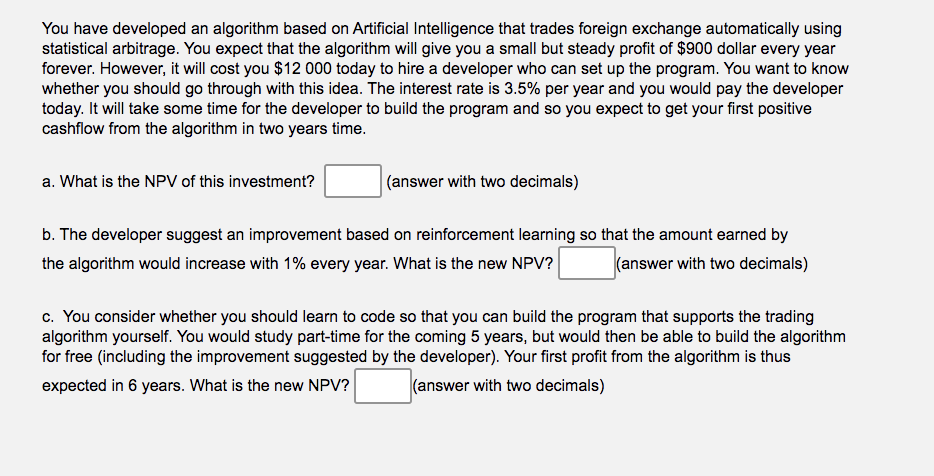

You have determined that you will need at least 3 000 000 SEK in private pension savings when you retire in 45 years. You plan to set aside a series of payments every year in an account yielding 6.5% per year to reach this goal. You will put the first payment in the account a year from today. a. If you make the same payments every year, what would your yearly payment be? The yearly payment would be SEK (answer with two decimals). b. Assume now that your first payment would be 12 000 and that the payments would increase with 4% per year as your salary increases. What would be the new balance in your pension account after 45 years? The balance in the account in 45 years would be million SEK. (Answer in millions; for example 3.45, and not 3 450 000. Round to two decimals). c. Assume as in b. a first yearly payment of 12 000 and yearly increase of the amount of 4%. What would the final payment into this pension account be? SEK (answer with two decimals) Cutting Edge Warehousing is considering a new project which would last for 3 years. They have forecasted the following cash flows over the years Year 0 Year 1 150 000 Year 2 200 000 Year 3 250 000 Sales (Revenue) |- COGS |(50% of sales) 75 000 100 000 125 000 25 000 25 000 25 000 Depreciation = EBIT | Taxes (30%) = Unlevered Net Income 50 000 15 000 75 000 22 500 100 000 30 000 35 000 52 500 70 000 Apart from the projections in the table above, Cutting Edge Warehousing also has capital expenditures (today) of 150 000, which will be depreciated straight-line over the three years of the project. They will also have to increase their investment in working capital by 9000 in year 1 and year 2. The entire working capital will be recovered in year 3. All values are in dollars and the cost of capital is 9% per year. a. What is the NPV of the Free Cash Flows from Cutting Edge's project? The is $ b. Now assume that the Free Cash Flows of Cutting Edge Warehousing is as shown in the table below (ignore your answer in a. and the table above). Further assume that after year 3 the free cash flow will increase with the industry average of 2% per year. Use the cost of capital of 9% and the discounted free cash flow model to estimate Cutting Edge's enterprise value. Year FCF (in $) 1 50 000 2 80 000 3 100 000 million (answer in millions with two decimals; 2.79 and not 2 790 Cutting Edge's Enterprise Value is $ 000). c. Assume now that Cutting Edge Warehousing Enterprise Value today is $900 000. They have no excess cash, $140 000 in debt and 100 000 shares outstanding. Estimate their share price. Their share price is $ (answer with two decimals). You have developed an algorithm based on Artificial Intelligence that trades foreign exchange automatically using statistical arbitrage. You expect that the algorithm will give you a small but steady profit of $900 dollar every year forever. However, it will cost you $ 12 000 today to hire a developer who can set up the program. You want to know whether you should go through with this idea. The interest rate is 3.5% per year and you would pay the developer today. It will take some time for the developer to build the program and so you expect to get your first positive cashflow from the algorithm in two years time. a. What is the NPV of this investment? (answer with two decimals) b. The developer suggest an improvement based on reinforcement learning so that the amount earned by the algorithm would increase with 1% every year. What is the new NPV? (answer with two decimals) c. You consider whether you should learn to code so that you can build the program that supports the trading algorithm yourself. You would study part-time for the coming 5 years, but would then be able to build the algorithm for free (including the improvement suggested by the developer). Your first profit from the algorithm is thus expected in 6 years. What is the new NPV? (answer with two decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts