Question: You have just completed a $23,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years

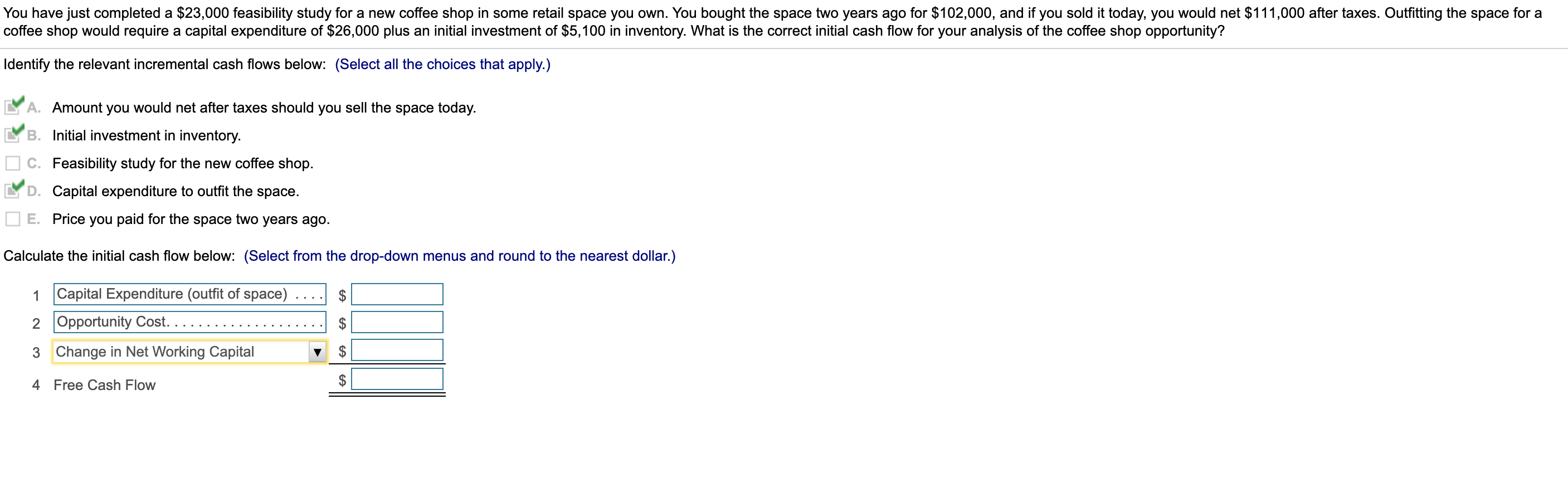

You have just completed a $23,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $102,000, and if you sold it today, you would net $111,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $26,000 plus an initial investment of $5,100 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? Identify the relevant incremental cash flows below: (Select all the choices that apply.) Amount you would net after taxes should you sell the space today. B. Initial investment in inventory. C. Feasibility study for the new coffee shop. D. Capital expenditure to outfit the space. E. Price you paid for the space two years ago. Calculate the initial cash flow below: (Select from the drop-down menus and round to the nearest dollar.) $ 1 Capital Expenditure (outfit of space) 2 Opportunity Cost. $ 3 Change in Net Working Capital $ 4 Free Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts