Question: You have performed the Markowitz optimization on a portfolio with 3 assets whose risk/return characteristics are summarized in the table below: Asset 1 Asset

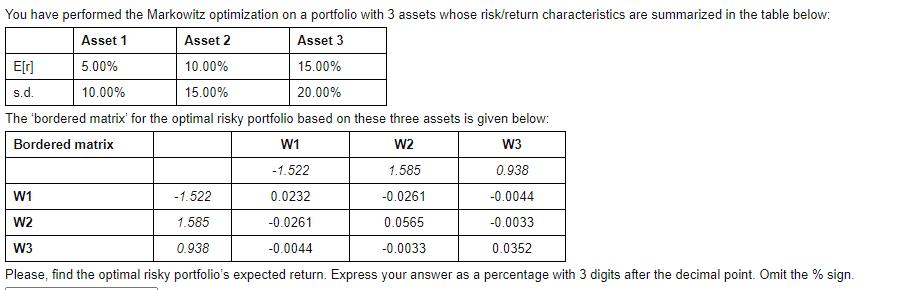

You have performed the Markowitz optimization on a portfolio with 3 assets whose risk/return characteristics are summarized in the table below: Asset 1 Asset 3 5.00% 15.00% 10.00% 20.00% The 'bordered matrix' for the optimal risky portfolio based on these three assets is given below: Bordered matrix W2 W3 1.585 0.938 W1 -1.522 -0.0261 -0.0044 W2 1.585 0.0565 -0.0033 W3 0.938 -0.0033 0.0352 Please, find the optimal risky portfolio's expected return. Express your answer as a percentage with 3 digits after the decimal point. Omit the % sign. E[r] s.d. Asset 2 10.00% 15.00% W1 -1.522 0.0232 -0.0261 -0.0044

Step by Step Solution

There are 3 Steps involved in it

To find the optimal risky portfolios expected return we need to use the bordered matrix ... View full answer

Get step-by-step solutions from verified subject matter experts