Question: You have recently completed your training contract and managed to save a small amount of money during the three years of your contract. You are

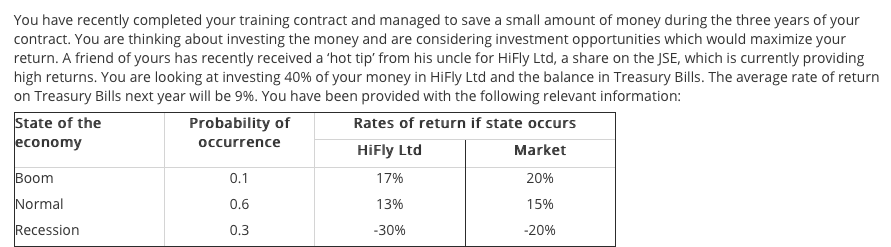

You have recently completed your training contract and managed to save a small amount of money during the three years of your contract. You are thinking about investing the money and are considering investment opportunities which would maximize your return. A friend of yours has recently received a hot tip from his uncle for HiFly Ltd, a share on the JSE, which is currently providing high returns. You are looking at investing 40% of your money in HiFly Ltd and the balance in Treasury Bills. The average rate of return on Treasury Bills next year will be 9%. You have been provided with the following relevant information:

(Refer to image attached)

ROUND ALL ANSWERS TO TWO DECIMAL PLACES

REQUIRED:

1. Calculate the expected return of HiFly Ltd.

2. Calculate the expected return of the market.

3. Calculate the standard deviation of HiFly Ltd.

4. Calculate the standard deviation of the market.

5. Calculate the covariance of returns between the market and HiFly Ltd.

6. Calculate the expected return on your portfolio.

You have recently completed your training contract and managed to save a small amount of money during the three years of your contract. You are thinking about investing the money and are considering investment opportunities which would maximize your return. A friend of yours has recently received a 'hot tip' from his uncle for HiFly Ltd, a share on the JSE, which is currently providing high returns. You are looking at investing 40% of your money in Hifly Ltd and the balance in Treasury Bills. The average rate of return on Treasury Bills next year will be 9%. You have been provided with the following relevant information: State of the Probability of Rates of return if state occurs economy occurrence HiFly Ltd Market Boom 0.1 17% 20% Normal 0.6 13% 15% Recession 0.3 -30% -20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts