Question: You have started a digital based fruit and vegetables business in your town and planning to expand in other cities. But for doing that you

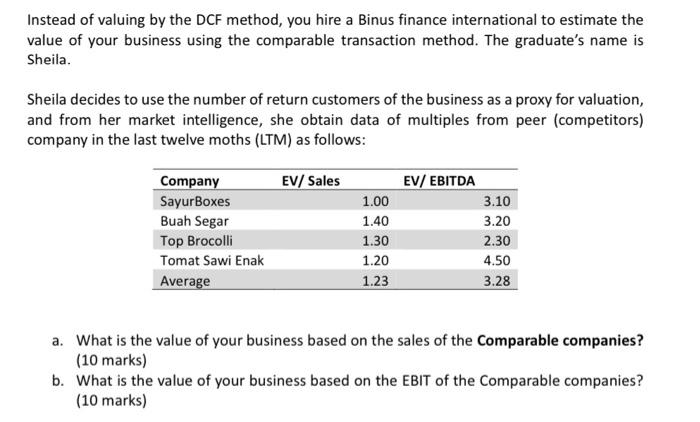

You have started a digital based fruit and vegetables business in your town and planning to expand in other cities. But for doing that you need additional capitals which could be obtained by selling part of your business to venture capitals or private angel investors. However, you know that to be able to do that you need to value you own business first. Therefore, you need to estimate the number of shares of your business that would need to be put on sale to the investors. Your current year profit before interest and taxes (EBIT) is IDR 1,5 billion from making annual sales of IDR 5 billion, which you expect to grow by an annual average of 20% for the next 5. years. Your also know that you must pay taxes annual taxes at around 25%. Further, the weighted average cost of capitals (WACC) of your business is 12%, and depreciation of fixed assets is IDR 200 million every year. The business is also making constant annual investment of IDR 500 million. Instead of valuing by the DCF method, you hire a Binus finance international to estimate the value of your business using the comparable transaction method. The graduate's name is Sheila. Sheila decides to use the number of return customers of the business as a proxy for valuation, and from her market intelligence, she obtain data of multiples from peer (competitors) company in the last twelve moths (LTM) as follows: Company SayurBoxes Buah Segar Top Brocolli Tomat Sawi Enak Average EV/ Sales 1.00 1.40 1.30 1.20 1.23 EV/ EBITDA 3.10 3.20 2.30 4.50 3.28 a. What is the value of your business based on the sales of the Comparable companies? (10 marks) b. What is the value of your business based on the EBIT of the Comparable companies? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts