Question: You have to construct the binomial tree first to find the strike price, then you can try to find the delta hedge. Kangaroo inc is

You have to construct the binomial tree first to find the strike price, then you can try to find the delta hedge.

You have to construct the binomial tree first to find the strike price, then you can try to find the delta hedge.

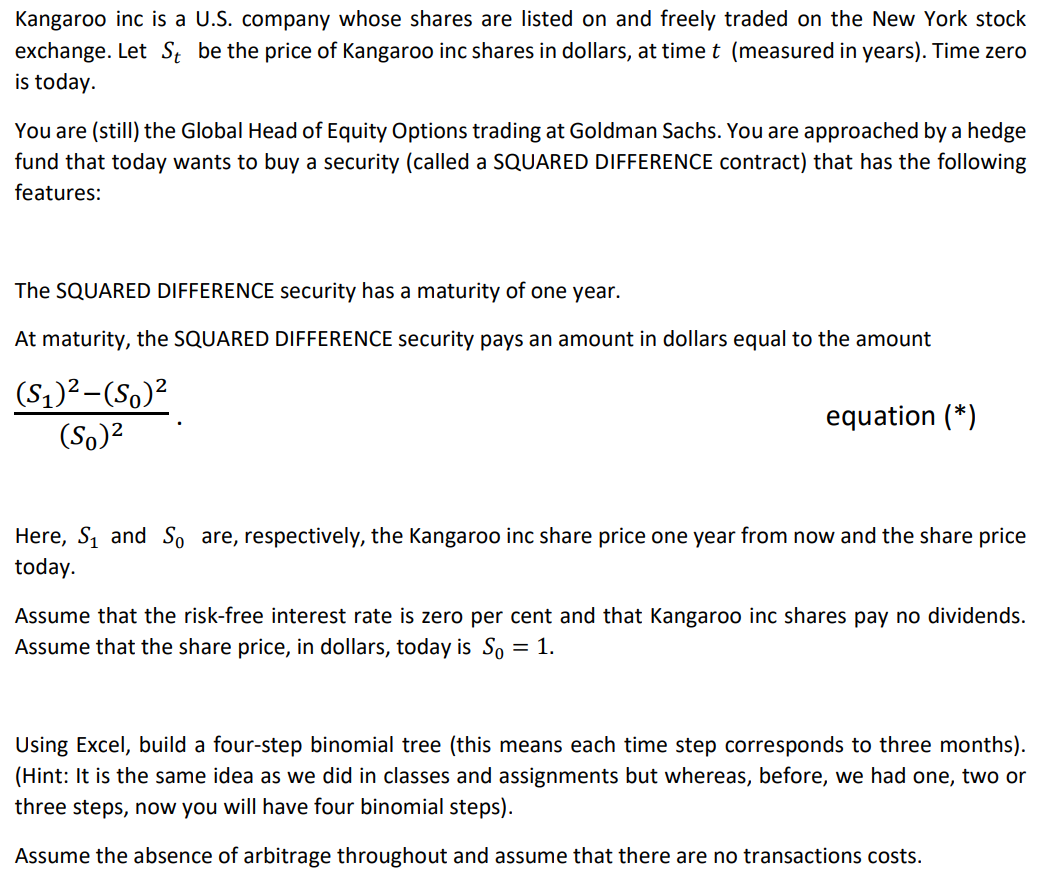

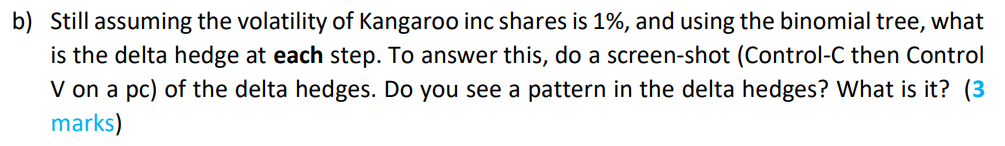

Kangaroo inc is a U.S. company whose shares are listed on and freely traded on the New York stock exchange. Let St be the price of Kangaroo inc shares in dollars, at time t (measured in years). Time zero is today. You are (still) the Global Head of Equity Options trading at Goldman Sachs. You are approached by a hedge fund that today wants to buy a security (called a SQUARED DIFFERENCE contract) that has the following features: The SQUARED DIFFERENCE security has a maturity of one year. At maturity, the SQUARED DIFFERENCE security pays an amount in dollars equal to the amount (51)2-(S.)2 (S.)2 equation (*) Here, S1 and So are, respectively, the Kangaroo inc share price one year from now and the share price today. Assume that the risk-free interest rate is zero per cent and that Kangaroo inc shares pay no dividends. Assume that the share price, in dollars, today is So = 1. Using Excel, build a four-step binomial tree (this means each time step corresponds to three months). (Hint: It is the same idea as we did in classes and assignments but whereas, before, we had one, two or three steps, now you will have four binomial steps). Assume the absence of arbitrage throughout and assume that there are no transactions costs. b) Still assuming the volatility of Kangaroo inc shares is 1%, and using the binomial tree, what is the delta hedge at each step. To answer this, do a screen-shot (Control-C then Control V on a pc) of the delta hedges. Do you see a pattern in the delta hedges? What is it? (3 marks) Kangaroo inc is a U.S. company whose shares are listed on and freely traded on the New York stock exchange. Let St be the price of Kangaroo inc shares in dollars, at time t (measured in years). Time zero is today. You are (still) the Global Head of Equity Options trading at Goldman Sachs. You are approached by a hedge fund that today wants to buy a security (called a SQUARED DIFFERENCE contract) that has the following features: The SQUARED DIFFERENCE security has a maturity of one year. At maturity, the SQUARED DIFFERENCE security pays an amount in dollars equal to the amount (51)2-(S.)2 (S.)2 equation (*) Here, S1 and So are, respectively, the Kangaroo inc share price one year from now and the share price today. Assume that the risk-free interest rate is zero per cent and that Kangaroo inc shares pay no dividends. Assume that the share price, in dollars, today is So = 1. Using Excel, build a four-step binomial tree (this means each time step corresponds to three months). (Hint: It is the same idea as we did in classes and assignments but whereas, before, we had one, two or three steps, now you will have four binomial steps). Assume the absence of arbitrage throughout and assume that there are no transactions costs. b) Still assuming the volatility of Kangaroo inc shares is 1%, and using the binomial tree, what is the delta hedge at each step. To answer this, do a screen-shot (Control-C then Control V on a pc) of the delta hedges. Do you see a pattern in the delta hedges? What is it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts