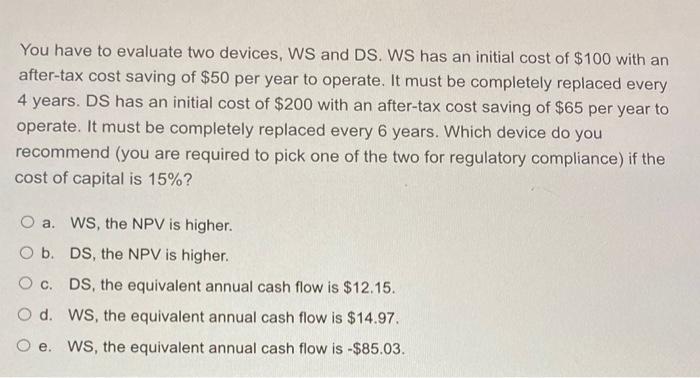

Question: You have to evaluate two devices, WS and DS. WS has an initial cost of $100 with an after-tax cost saving of $50 per year

You have to evaluate two devices, WS and DS. WS has an initial cost of $100 with an after-tax cost saving of $50 per year to operate. It must be completely replaced every 4 years. DS has an initial cost of $200 with an after-tax cost saving of $65 per year to operate. It must be completely replaced every 6 years. Which device do you recommend (you are required to pick one of the two for regulatory compliance) if the cost of capital is 15%? O a. WS, the NPV is higher. O b. DS, the NPV is higher. Oc. DS, the equivalent annual cash flow is $12.15. O d. WS, the equivalent annual cash flow is $14.97 O e. WS, the equivalent annual cash flow is -$85.03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts