Question: you have to use the table, thanks Using the tox table, determine the amount of taxes for the following situations: (Do not round intermediate calculations.

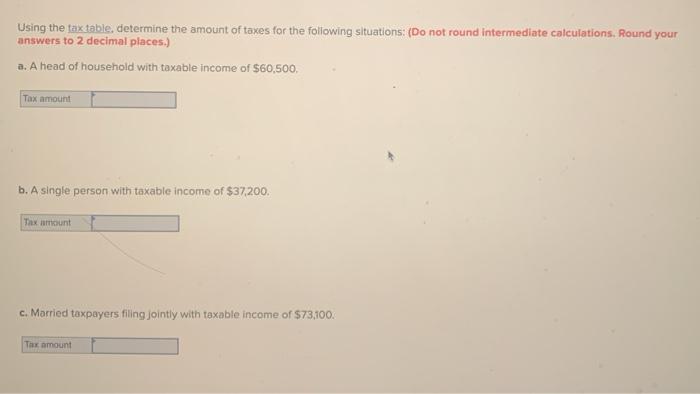

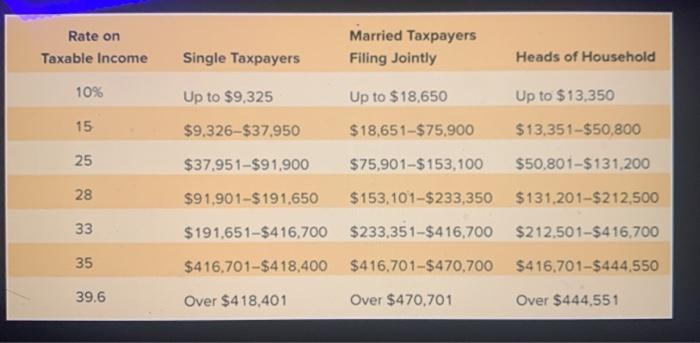

Using the tox table, determine the amount of taxes for the following situations: (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. A head of household with taxable income of $60,500, Tax amount b. A single person with taxable income of $37,200. Thx amount c. Married taxpayers filing jointly with taxable income of $73,100. Thx amount Rate on Taxable income Married Taxpayers Filing Jointly Single Taxpayers Heads of Household 10% 15 25 Up to $9,325 Up to $18,650 Up to $13,350 $9.326-$37.950 $18,651-$75,900 $13,351-$50,800 $37.951-$91,900 $75,901-$ 153,100 $50,801-$131,200 $91,901-$191,650 $153.101-$233,350 $131,201-$212,500 $191.651-$416,700 $233,351-$416,700 $212.501-$416.700 28 33 35 $416,701-$418,400 $416.701-$470.700 $416.701-$444,550 39.6 Over $418,401 Over $470.701 Over $444,551

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts