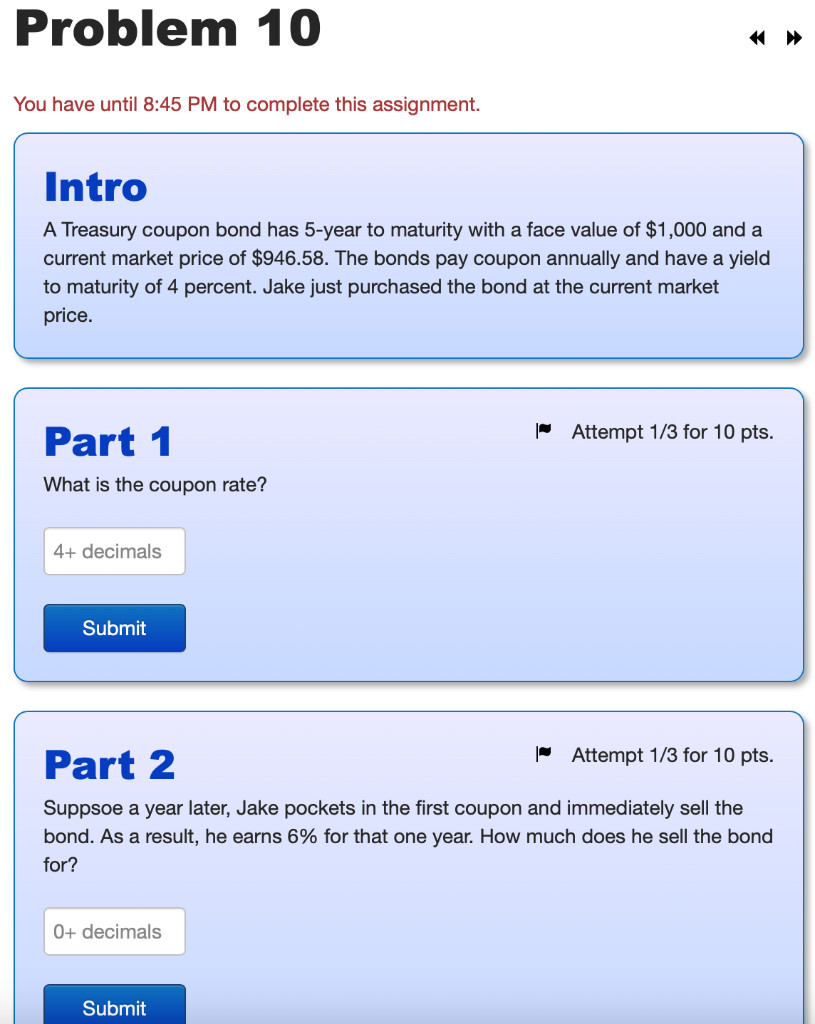

Question: You have until 8:45 PM to complete this assignment. Intro A Treasury coupon bond has 5 -year to maturity with a face value of $1,000

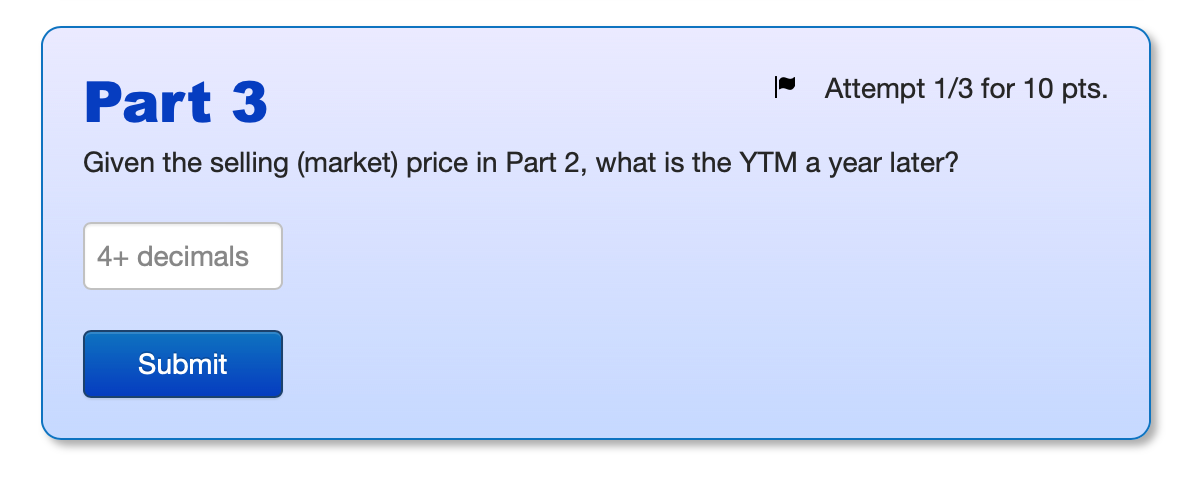

You have until 8:45 PM to complete this assignment. Intro A Treasury coupon bond has 5 -year to maturity with a face value of $1,000 and a current market price of $946.58. The bonds pay coupon annually and have a yield to maturity of 4 percent. Jake just purchased the bond at the current market price. Part 1 Attempt 1/3 for 10 pts. What is the coupon rate? Part 2 Attempt 1/3 for 10 pts. Suppsoe a year later, Jake pockets in the first coupon and immediately sell the bond. As a result, he earns 6% for that one year. How much does he sell the bond for? Given the selling (market) price in Part 2, what is the YTM a year later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts