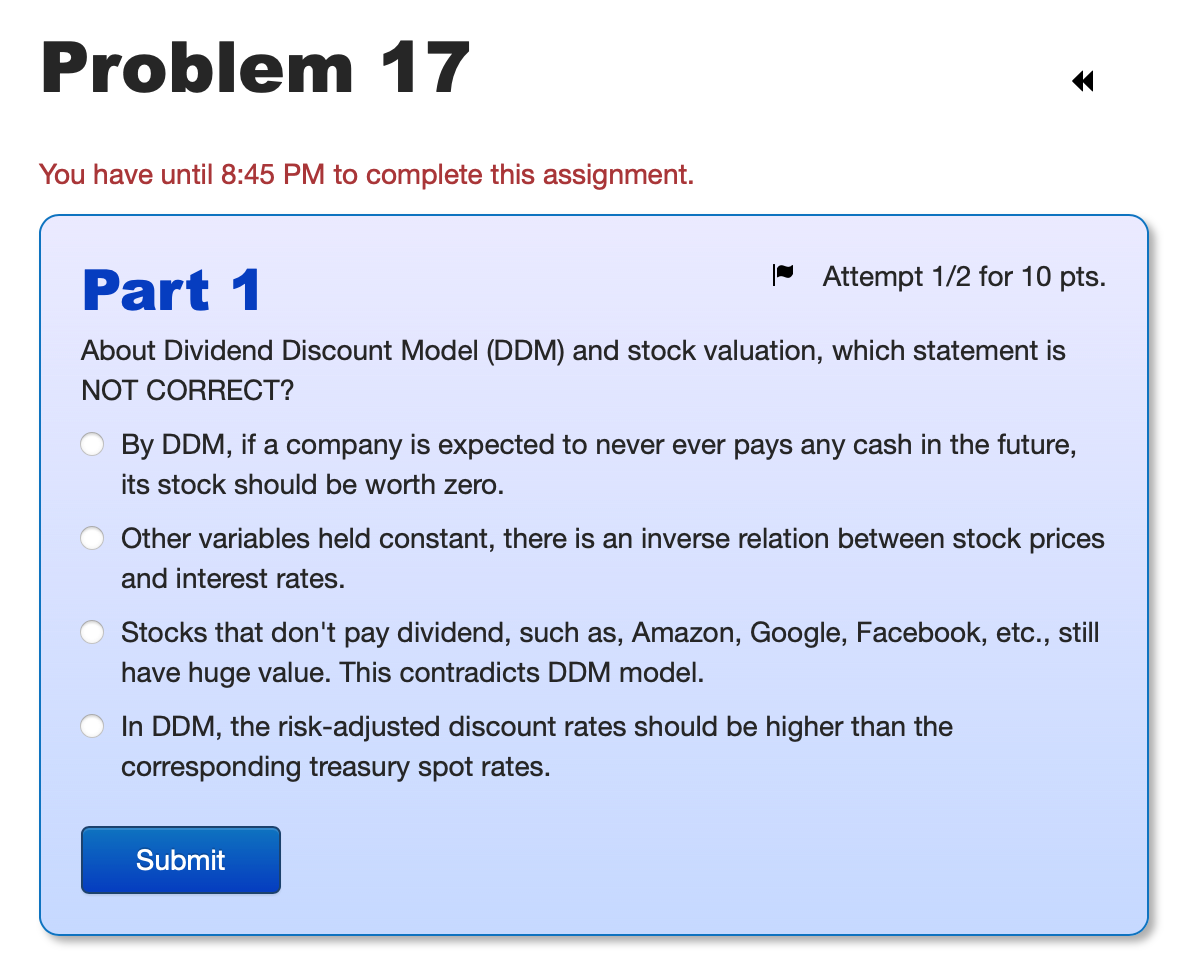

Question: You have until 8:45 PM to complete this assignment. Part 1 Attempt 1/2 for 10 pts. About Dividend Discount Model (DDM) and stock valuation, which

You have until 8:45 PM to complete this assignment. Part 1 Attempt 1/2 for 10 pts. About Dividend Discount Model (DDM) and stock valuation, which statement is NOT CORRECT? By DDM, if a company is expected to never ever pays any cash in the future, its stock should be worth zero. Other variables held constant, there is an inverse relation between stock prices and interest rates. Stocks that don't pay dividend, such as, Amazon, Google, Facebook, etc., still have huge value. This contradicts DDM model. In DDM, the risk-adjusted discount rates should be higher than the corresponding treasury spot rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts