Question: You may select two countries (can use the charts . Then, based on (outside evaluation methods), briefly discuss what decision you are going to make

You may select two countries (can use the charts . Then, based on (outside evaluation methods), briefly discuss what decision you are going to make about the country risk of those two countries and justify your decision.

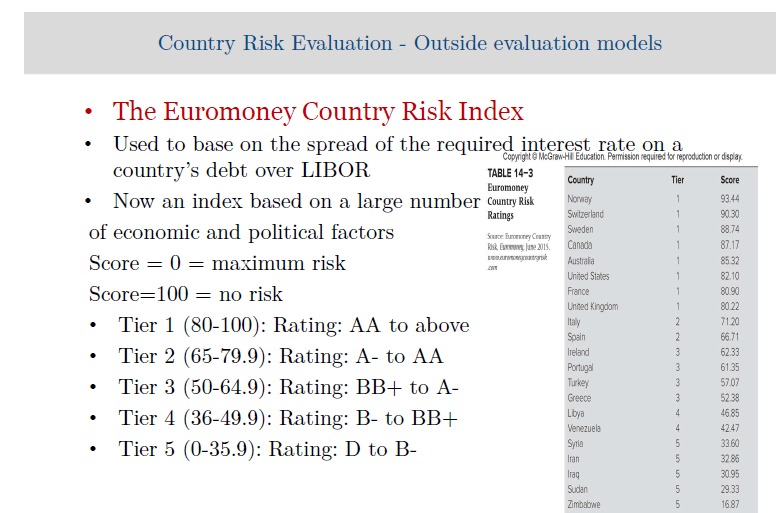

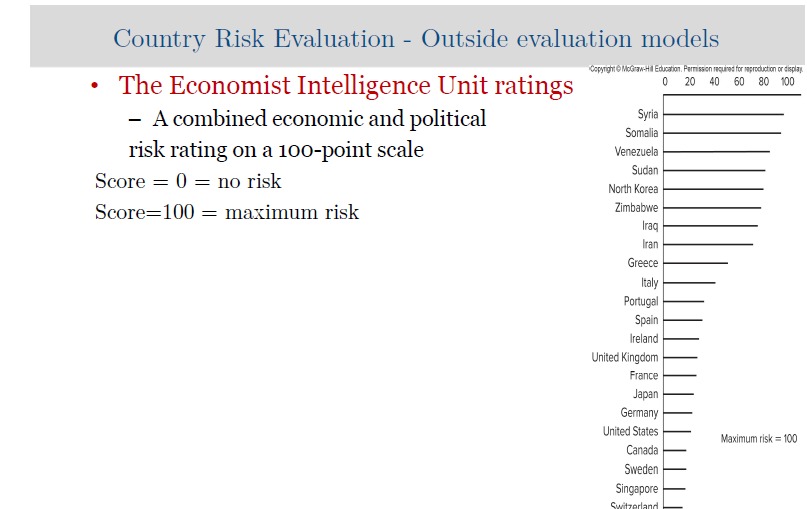

Country Risk Evaluation - Outside evaluation models . The Euromoney Country Risk Index . Used to base on the spread of the required interest rate on a Copyright @ McGrew-Hil Education. Permission required for reproduction or display country's debt over LIBOR TABLE 14-3 Euromoney Country Tier Score . Now an index based on a large number Country Risk Norway 93.44 Ratings Switzerland 90.30 of economic and political factors Soure Euromoney County Sweden 88.74 Canada 87.17 Score = 0 = maximum risk Australia 85.32 United States 82.10 Score=100 = no risk France 80.90 United Kingdom 80.22 . Tier 1 (80-100): Rating: AA to above Italy 7120 Spain 66.71 . Tier 2 (65-79.9): Rating: A- to AA Ireland 62.33 Portugal 61.35 . Tier 3 (50-64.9): Rating: BB+ to A- Turkey 57.07 Greece 52.38 . Tier 4 (36-49.9): Rating: B- to BB+ Libya 46.85 Venezuela 4 42.47 . Tier 5 (0-35.9): Rating: D to B- Syria 33.60 Iran 32 86 Iraq 30.95 Sudan 29.33 Zimbabwe 16.87Country Risk Evaluation - Outside evaluation models Copyright @ Mccaw-Hil Education. Permission required for mproduction or display . The Economist Intelligence Unit ratings 0 20 40 60 80 100 - A combined economic and political Syria Somalia risk rating on a 100-point scale Venezuela Sudan Score = 0 = no risk North Korea Score=100 = maximum risk Zimbabwe Iraq Iran Greece Italy Portugal Spain Ireland United Kingdom France Japan Germany United States Maximum risk = 100 Canada Sweden Singapore

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts