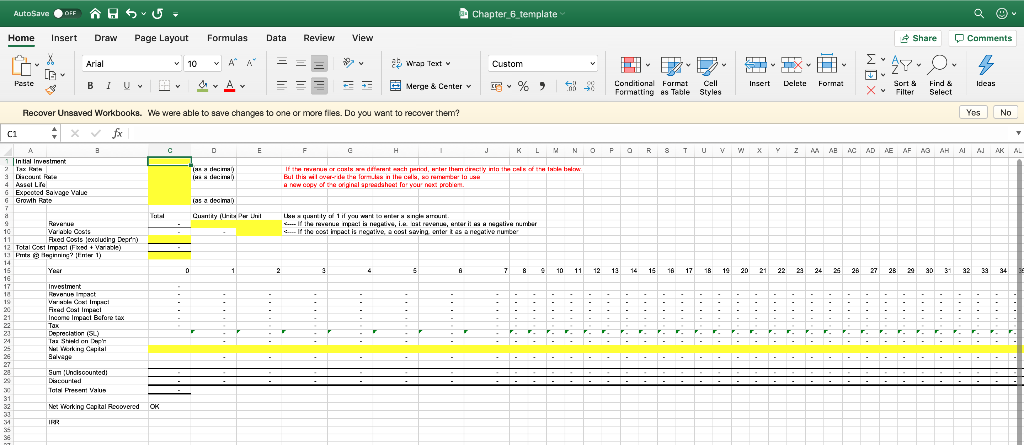

Question: You may use the Excel spreadsheet named Chapter6_template.xls to answer the following question. If you choose to answer the question without using the spreadsheet, be

You may use the Excel spreadsheet named Chapter6_template.xls to answer the following question. If you choose to answer the question without using the spreadsheet, be careful to show all work, so your marker can follow your calculation and award partial marks as needed.

You may use the Excel spreadsheet named Chapter6_template.xls to answer the following question. If you choose to answer the question without using the spreadsheet, be careful to show all work, so your marker can follow your calculation and award partial marks as needed.

6.1 You and your friends are thinking about starting a motorcycle company named Apple Valley Choppers. Your initial investment would be $500,000 for depreciable equipment, which should last five years, and your tax rate would be 40%. You could sell a chopper for $10,000, assuming your average variable cost per chopper is $3000, and assuming fixed costs, such as rent, utilities, and salaries, would be $200,000 per year. (12 marks)

- Accounting breakeven: How many choppers would you have to sell for net income to equal zero, ignoring the costs of financing? (1 mark)

- Financial breakeven: How many choppers would you have to sell to generate NPV of zero, if you required a 15% return? (Hint: Use the 15% as the discount rate and calculate net present value. In Excel, you may want to use the Goal Seek command, or simply use trial and error to find the correct amount.) (2 marks)

- Assuming you could sell 60 choppers per year, what would be your IRR? (2 marks)

- Assuming you could sell 60 choppers per year, what would your selling price have to be to generate a net present value of $150,000 at a 15% discount rate? (2 marks)

- If you could sell 60 choppers in the first year, and your sales volume increased by 5% each year until the end of year five, what would the net present value be at a 15% discount rate? (2 marks)

- If, at the beginning of each year, you expect to need working capital equal to 10% of the next (coming) years sales revenue, what would be the effect on the net present value of the project? Only changes in the amount of working capital require cash flows. Assume a sales price of $10,000 per chopper and a sales quantity of 60 choppers. (2 marks)

Remember that any money invested in working capital (i.e., inventory, accounts receivable, accounts payable) would usually be recovered in its entirety at the end of the project.

Chapter 6_template AutoSave Home Insert View Draw Arial B I $ u- Page Layout 10 U Formulas A A YA Data = E Review = = Custom Wraa Text Merge & Center - 1 Conditional Format 3 - Insert Share Comments Ey O 4 Sort Hird & Ideas E % Soll cell Delete Forma: Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? Yes No I J K L M N O P R T U V W X Y Z A AB AC AD AE AF NG AH AI AJ AK AL 1 In Hislostment 2 Tax R DATE PO Asset Lle G Expooted Savage Value Growth Rais IF THWHTLINHO C X differch Hur thirstly in the But this will forms in worlu A copy of the original aprodahoe for your next probe as a decimal . y : 1 if ----- It is IN : nga, i.s intre , Mariic H Impalii C... I the oogt impact is nato, a coal swing ontert as a negative number Varadle Costs Feed Cosis excluding Decay 12 Tetal Cost Impact Fx + Vrvale) 13 P i nning? Ini 1) 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 VH Coxilm : Depreciation (3) Tas Shdon p'n Mw. Verk ng Cp &NRUNNSB3 Sum Undiscountedt Dould Net Virking Capital covered Chapter 6_template AutoSave Home Insert View Draw Arial B I $ u- Page Layout 10 U Formulas A A YA Data = E Review = = Custom Wraa Text Merge & Center - 1 Conditional Format 3 - Insert Share Comments Ey O 4 Sort Hird & Ideas E % Soll cell Delete Forma: Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? Yes No I J K L M N O P R T U V W X Y Z A AB AC AD AE AF NG AH AI AJ AK AL 1 In Hislostment 2 Tax R DATE PO Asset Lle G Expooted Savage Value Growth Rais IF THWHTLINHO C X differch Hur thirstly in the But this will forms in worlu A copy of the original aprodahoe for your next probe as a decimal . y : 1 if ----- It is IN : nga, i.s intre , Mariic H Impalii C... I the oogt impact is nato, a coal swing ontert as a negative number Varadle Costs Feed Cosis excluding Decay 12 Tetal Cost Impact Fx + Vrvale) 13 P i nning? Ini 1) 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 VH Coxilm : Depreciation (3) Tas Shdon p'n Mw. Verk ng Cp &NRUNNSB3 Sum Undiscountedt Dould Net Virking Capital covered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts