Question: You may use your own spreadsheet or use the one provided: 2021 Mid Term 1 - Firm Value DCE Template.xlsx Please make sure two things

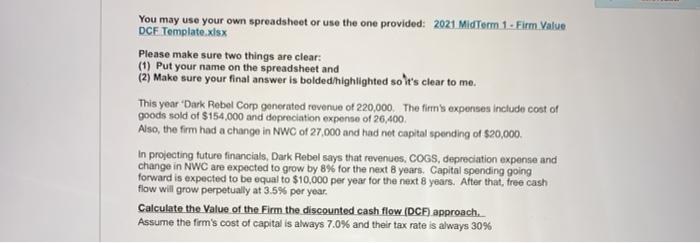

You may use your own spreadsheet or use the one provided: 2021 Mid Term 1 - Firm Value DCE Template.xlsx Please make sure two things are clear: (1) Put your name on the spreadsheet and (2) Make sure your final answer is bolded highlighted soit's clear to me. This year "Dark Rebel Corp generated revenue of 220,000. The firm's expenses include cost of goods sold of $154,000 and depreciation expense of 26,400 Also, the firm had a change in NWC of 27,000 and had not capital spending of $20,000. in projecting future financials, Dark Rebel says that revenues, COGS, depreciation expense and change in NWC are expected to grow by 8% for the next years, Capital spending going forward is expected to be equal to $10,000 per year for the next 8 years. After that, free cash flow will grow perpetually at 3.5% per year. Calculate the value of the Firm the discounted cash flow (DCF) appronch. Assure the firm's cost of capital is always 7.0% and their tax rate is always 30% You may use your own spreadsheet or use the one provided: 2021 Mid Term 1 - Firm Value DCE Template.xlsx Please make sure two things are clear: (1) Put your name on the spreadsheet and (2) Make sure your final answer is bolded highlighted soit's clear to me. This year "Dark Rebel Corp generated revenue of 220,000. The firm's expenses include cost of goods sold of $154,000 and depreciation expense of 26,400 Also, the firm had a change in NWC of 27,000 and had not capital spending of $20,000. in projecting future financials, Dark Rebel says that revenues, COGS, depreciation expense and change in NWC are expected to grow by 8% for the next years, Capital spending going forward is expected to be equal to $10,000 per year for the next 8 years. After that, free cash flow will grow perpetually at 3.5% per year. Calculate the value of the Firm the discounted cash flow (DCF) appronch. Assure the firm's cost of capital is always 7.0% and their tax rate is always 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts