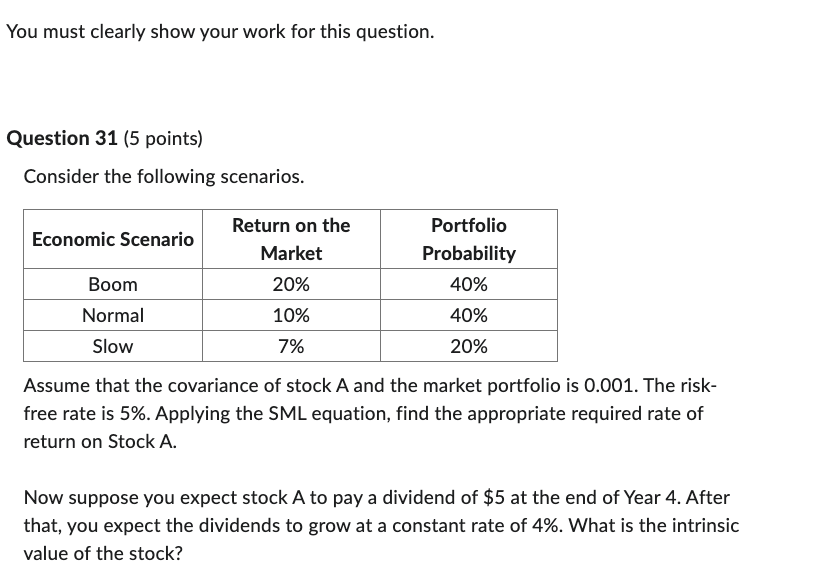

Question: You must clearly show your work for this question. Consider the following scenarios. Please refer to data table in the photo. Assume that the covariance

You must clearly show your work for this question. Consider the following scenarios. Please refer to data table in the photo. Assume that the covariance of stock A and the market portfolio is The riskfree rate is Applying the SML equation, find the appropriate required rate of return on Stock A

Now suppose you expect stock A to pay a dividend of $ at the end of Year After that, youexpect the dividends to grow at a constant rate of What is the intrinsic value of the stock?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock