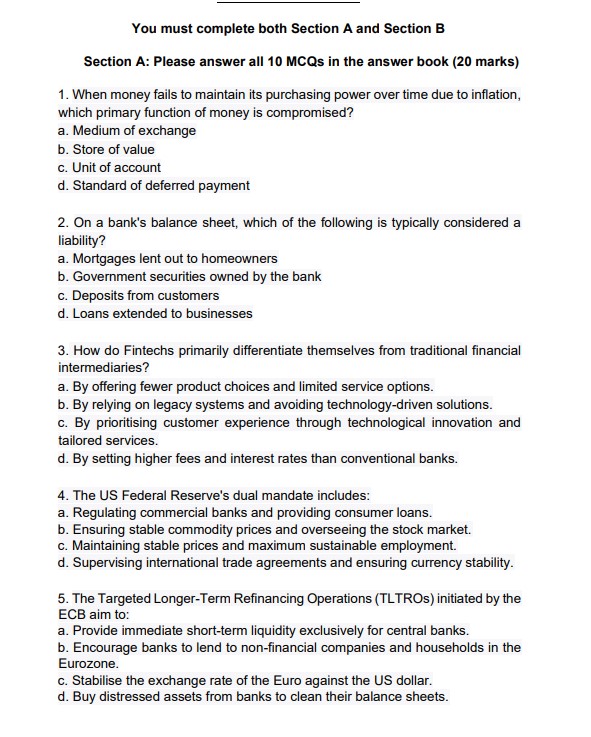

Question: You must complete both Section A and Section B Section A: Please answer all 1 0 MCQs in the answer book ( 2 0 marks

You must complete both Section A and Section B

Section A: Please answer all MCQs in the answer book marks

When money fails to maintain its purchasing power over time due to inflation, which primary function of money is compromised?

a Medium of exchange

b Store of value

c Unit of account

d Standard of deferred payment

On a bank's balance sheet, which of the following is typically considered a liability?

a Mortgages lent out to homeowners

b Government securities owned by the bank

c Deposits from customers

d Loans extended to businesses

How do Fintechs primarily differentiate themselves from traditional financial intermediaries?

a By offering fewer product choices and limited service options.

b By relying on legacy systems and avoiding technologydriven solutions.

c By prioritising customer experience through technological innovation and tailored services.

d By setting higher fees and interest rates than conventional banks.

The US Federal Reserve's dual mandate includes:

a Regulating commercial banks and providing consumer loans.

b Ensuring stable commodity prices and overseeing the stock market.

c Maintaining stable prices and maximum sustainable employment.

d Supervising international trade agreements and ensuring currency stability.

The Targeted LongerTerm Refinancing Operations TLTROs initiated by the ECB aim to:

a Provide immediate shortterm liquidity exclusively for central banks.

b Encourage banks to lend to nonfinancial companies and households in the Eurozone.

c Stabilise the exchange rate of the Euro against the US dollar.

d Buy distressed assets from banks to clean their balance sheets. The concept of "web in the context of finance emphasises:

a A centralised internet dominated by a few corporations.

b A return to traditional, noncrypto financial mechanisms.

c A vision for a decentralised internet where users control their data and interactions, often powered by blockchain.

d A new type of web browser focused on faster browsing speeds without blockchain integrations.

While both money and cash facilitate transactions, what distinguishes cash in most modern economies?

a Cash can earn interest, while money cannot.

b Cash is a form of digital currency used online.

c Cash represents physical tokens or notes, whereas money can also encompass digital or virtual representations.

d Cash's primary function is to serve as collateral for loans, while money is for everyday transactions.

When a central bank wants to combat inflation using Open Market Operations OMOs it will most likely:

a Purchase government securities to increase the money supply.

b Lower the reserve requirement to allow more bank lending.

c Sell government securities to absorb excess liquidity.

d Decrease the interest rate it charges banks for borrowing.

A central bank decides to decrease the reserve requirement. This would most likely result in:

a A decrease in the number of loans banks can issue.

b An increase in the interest rates on savings accounts.

c A contraction in the money supply due to lower liquidity.

d An expansion of the money supply due to increased lending capacity for banks.

The "Paradox of banknotes", often referred to as the cash paradox, is a phenomenon observed in many countries. What does this paradox primarily address?

a The decreasing use of physical cash as digital payment methods rise.

b The increasing demand for banknotes even as electronic transactions become more prevalent.

c The consistent value of banknotes across different economies.

d The correlation between the printing of banknotes and inflation rates.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock