Question: You must do all question. Number shown in parentheses for each question indicates how many points cach is worth. It is to your advantage to

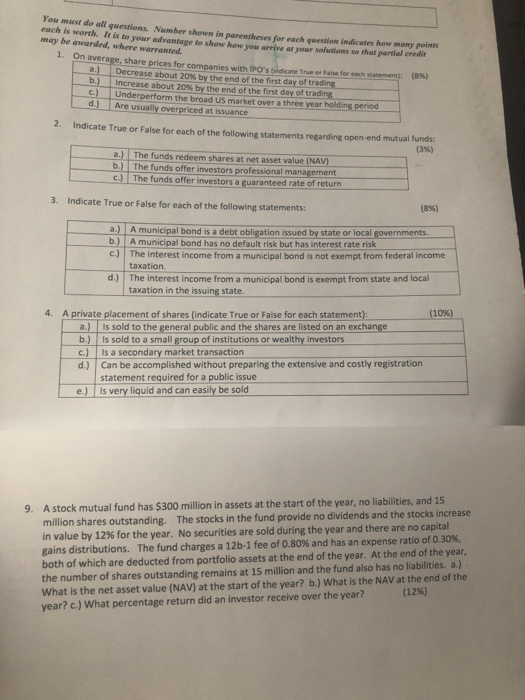

You must do all question. Number shown in parentheses for each question indicates how many points cach is worth. It is to your advantage to show how yw arrive at your solutions so that partial credit may be awarded, where warranted. 1On average, share prices for companies with Po's uncate True or False for eachm ent (87) a.) Decrease about 20% by the end of the first day of trading b) Increase about 20% by the end of the first day of trading C) Underperform the broad US market over a three year holding period d.) Are usually overpriced at issuance 2 Indicate True or False for each of the following statements regarding open-end mutual funds (3%) a.) The funds redeem shares at net asset value (NAV) b.) The funds offer investors professional management c.) The funds offer investors a guaranteed rate of return 3. Indicate True or False for each of the following statements: (8%) a.) A municipal bond is a debt obligation issued by state or local governments. b.) A municipal bond has no default risk but has interest rate risk c.) The interest income from a municipal bond is not exempt from federal income taxation d.) The interest income from a municipal bond is exempt from state and local taxation in the issuing state. 4. (10%) A private placement of shares (indicate True or False for each statement): a.) Is sold to the general public and the shares are listed on an exchange b.) Is sold to a small group of institutions or wealthy investors c.) Is a secondary market transaction d.) Can be accomplished without preparing the extensive and costly registration statement required for a public issue e.) Is very liquid and can easily be sold 9. A stock mutual fund has $300 million in assets at the start of the year, no liabilities, and 15 million shares outstanding. The stocks in the fund provide no dividends and the stocks increase in value by 12% for the year. No securities are sold during the year and there are no capital gains distributions. The fund charges a 12b-1 fee of 0.80% and has an expense ratio of 0.30%, both of which are deducted from portfolio assets at the end of the year. At the end of the year, the number of shares outstanding remains at 15 million and the fund also has no liabilities. a.) What is the net asset value (NAV) at the start of the year? b.) What is the NAV at the end of the (12%) year? c) What percentage return did an investor receive over the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts