Question: YOU MUST HAVE CORRECT ANSWER OR ELSE I'LL DOWNVOTE HERE IS THE PROBLEM AND ITS SOLUTION Cisco, Inc., has a proposal from the Engineering Planning

YOU MUST HAVE CORRECT ANSWER OR ELSE I'LL DOWNVOTE

HERE IS THE PROBLEM AND ITS SOLUTION

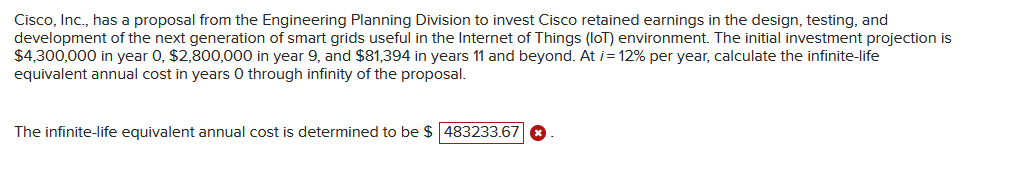

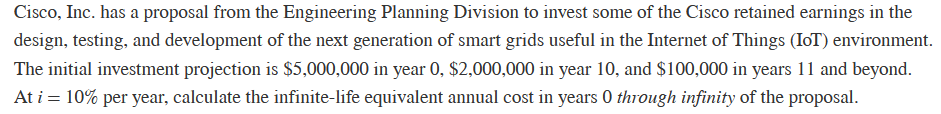

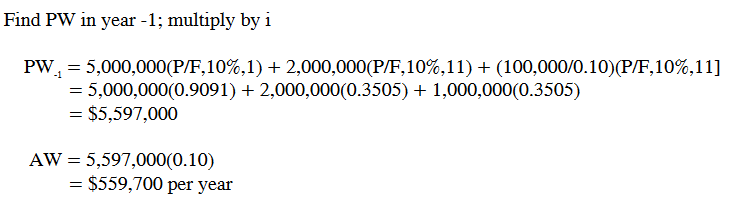

Cisco, Inc., has a proposal from the Engineering Planning Division to invest Cisco retained earnings in the design, testing, and development of the next generation of smart grids useful in the Internet of Things (loT) environment. The initial investment projection is $4,300,000 in year 0,$2,800,000 in year 9 , and $81,394 in years 11 and beyond. At i=12% per year, calculate the infinite-life equivalent annual cost in years 0 through infinity of the proposal. The infinite-life equivalent annual cost is determined to be $ Cisco, Inc. has a proposal from the Engineering Planning Division to invest some of the Cisco retained earnings in the design, testing, and development of the next generation of smart grids useful in the Internet of Things (IoT) environment. The initial investment projection is $5,000,000 in year 0,$2,000,000 in year 10 , and $100,000 in years 11 and beyond. At i=10% per year, calculate the infinite-life equivalent annual cost in years 0 through infinity of the proposal. Find PW in year -1 ; multiply by i PW1AW=5,000,000(P/F,10%,1)+2,000,000(P/F,10%,11)+(100,000/0.10)(P/F,10%,11]=5,000,000(0.9091)+2,000,000(0.3505)+1,000,000(0.3505)=$5,597,000=5,597,000(0.10)=$559,700peryear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts