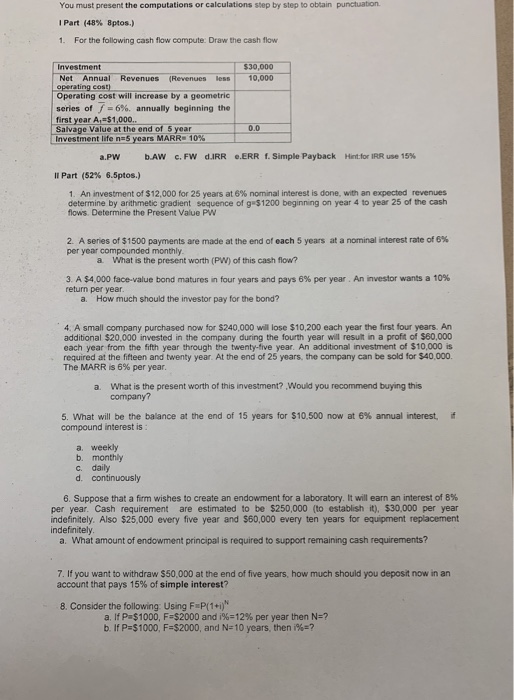

Question: You must present the computations or calculations step by step to obtain punctuation Part (48% 8ptos.) 1. For the following cash flow compute: Draw the

You must present the computations or calculations step by step to obtain punctuation Part (48% 8ptos.) 1. For the following cash flow compute: Draw the cash flow Investment 0,000 Net Annual Revenues (Revenues less 10,000 operating cost Operating cost will increase by a geometric series of 6%, annually beginning the first year A $1,000 Salvage Value at the end of 5 year 0.0 Tnvestment life n.5 years. MARR, 10% a.PW bAw c, FW d.IRR e.ERRf. Simple Payback Hrtfor lRR use 15% 11 Part (52% 6.5ptos.) 1. An investment of $12,000 for 25 years at 6% nominal interest is done, with an expected revenues determine by arithmetic gradient sequence of g $1200 beginning on year 4 to year 25 of the cash flows. Determine the Present Value PW 2. A seres of $1500 payments are made at the end of each 5 years at a nominal interest rate of 6% per year compounded monthly a. What is the present worth (PW) of this cash fow? vestor wants a 10% 3, A $4,000 face-value bond matures n four years and pays 6% per year. An return per year a. How much should the investor pay for the bond? 4. A small company purchased now for $240,000 will lose $10,200 each year the first four years. An additional $20,000 invested in the company during the fourth year will result in a profit of $80,000 each year from the fifth year through the twenty-five year. An additional investment of $10,000 i required at the fifteen and twenty year. At the end of 25 years, the company can be sold for S$40,000. The MARR is 6% per year. a. What is the present worth of this investment?,Would you recommend buying this company? 5. What will be the balance at the end of 15 years for $10,500 now at 6% annual interest, compound interest is if a. weekly b. monthly c. daily d. continuously 6. Suppose that a firm wishes to create an endowment for a laboratory, t will earn an interest of 8% per year. Cash requirement are estimated to be $250,000 (to establish it), $30,000 per year indefinitely. Also $25,000 every five year and $60,000 every ten years for equipment replacement indefinitely a. What amount of endowment principal is required to support remaining cash requirements? 7. If you want to withdraw $50,000 at the end of five years, how much should you deposit now in an account that pays 15% of simple interest? 8. Consider the following Using FaP(1i a. If Pa$1000, F-$2000 and i% 12% per year then N:? b. If P-31000, F-S2000, and Ne 10 years, then i%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts