Question: You must show all your work/computations to receive full credit. You must submit your solutions on Canvas using one of these formats: Word, PDF, or

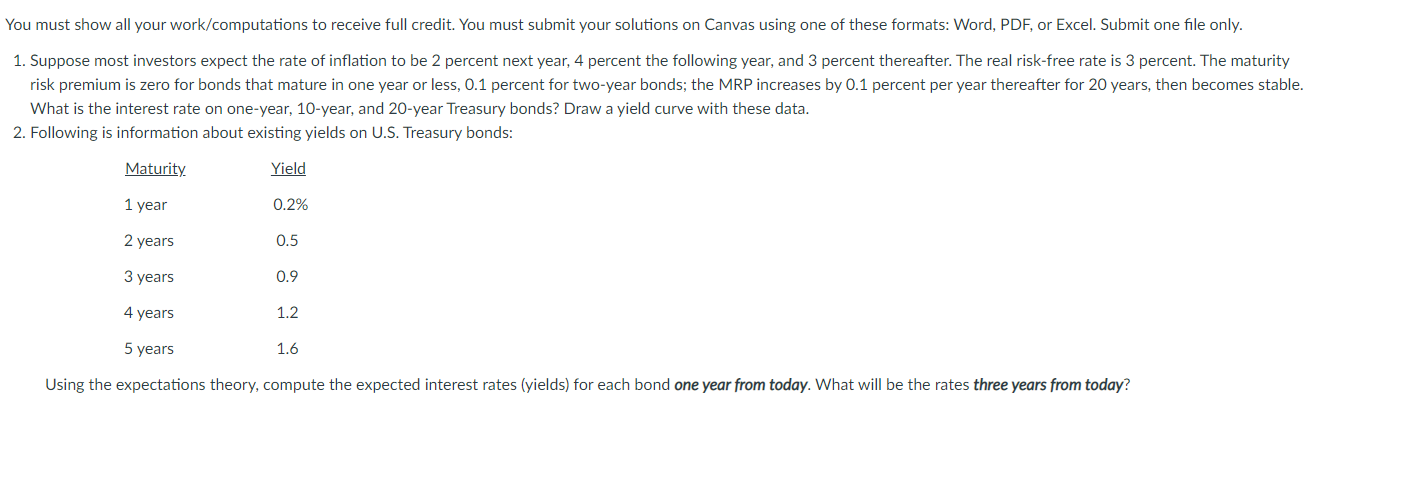

You must show all your work/computations to receive full credit. You must submit your solutions on Canvas using one of these formats: Word, PDF, or Excel. Submit one file only. 1. Suppose most investors expect the rate of inflation to be 2 percent next year, 4 percent the following year, and 3 percent thereafter. The real risk-free rate is 3 percent. The maturity risk premium is zero for bonds that mature in one year or less, 0.1 percent for two-year bonds; the MRP increases by 0.1 percent per year thereafter for 20 years, then becomes stable. What is the interest rate on one-year, 10-year, and 20-year Treasury bonds? Draw a yield curve with these data. 2. Following is information about existing yields on U.S. Treasury bonds: Maturity Yield 1 year 0.2% 2 years 0.5 3 years 0.9 4 years 1.2 5 years 1.6 Using the expectations theory, compute the expected interest rates (yields) for each bond one year from today. What will be the rates three years from today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts