Question: You need $550 to start this business. For instance let's assume You put $300 from your own savings into this business. You are the only

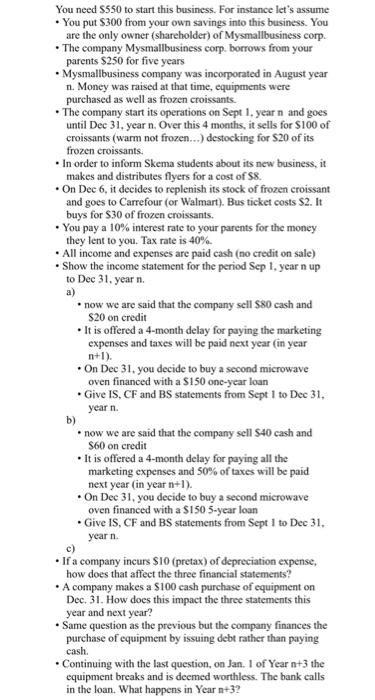

You need $550 to start this business. For instance let's assume You put $300 from your own savings into this business. You are the only owner (shareholder) of Mysmallbusiness corp The company Mysmallbusiness corp. borrows from your parents $250 for five years Mysmallbusiness company was incorporated in August year n. Money was raised at that time, equipments were purchased as well as frozen croissants The company start its operations on Sept 1 year n and goes until Dec 31, year n. Over this 4 months, it sells for $100 of croissants (warm not frozen...) destocking for $20 of its frozen croissants. . In order to inform Skema students about its new business, it makes and distributes flyers for a cost of $8. . On Dec 6, it decides to replenish its stock of frozen croissant and goes to Carrefour (or Walmart). Bus ticket costs $2. It buys for $30 of frozen croissants. You pay a 10% interest rate to your parents for the money they lent to you. Tax rate is 40%. All income and expenses are paid cash (no credit on sale) Show the income statement for the period Sep 1, year n up to Dec 31, year n. a) . now we are said that the company sell S80 cash and $20 on credit It is offered a 4-month delay for paying the marketing expenses and taxes will be paid next year (in year n+1). On Dec 31. you decide to buy a second microwave oven financed with a $150 onc-year loan . Give IS, CF and BS statements from Sept 1 to Dec 31, yearn. b) now we are said that the company sell S40 cash and $60 on credit It is offered a 4-month delay for paying all the marketing expenses and 50% of taxes will be paid next year in year n+1). On Dec 31, you decide to buy a second microwave oven financed with a $150 5-year loan . Give IS, CF and BS statements from Sept I to Dec 31. year n. If a company incurs SIO (pretax) of depreciation expense, how does that affect the three financial statements? A company makes a $100 cash purchase of equipment on Dec. 31. How does this impact the three statements this year and next year? Same question as the previous but the company finances the purchase of equipment by issuing debt rather than paying cash. Continuing with the last question, on Jan. 1 of Year n+3 the equipment breaks and is deemed worthless. The bank calls in the loan. What happens in Year n+3? You need $550 to start this business. For instance let's assume You put $300 from your own savings into this business. You are the only owner (shareholder) of Mysmallbusiness corp The company Mysmallbusiness corp. borrows from your parents $250 for five years Mysmallbusiness company was incorporated in August year n. Money was raised at that time, equipments were purchased as well as frozen croissants The company start its operations on Sept 1 year n and goes until Dec 31, year n. Over this 4 months, it sells for $100 of croissants (warm not frozen...) destocking for $20 of its frozen croissants. . In order to inform Skema students about its new business, it makes and distributes flyers for a cost of $8. . On Dec 6, it decides to replenish its stock of frozen croissant and goes to Carrefour (or Walmart). Bus ticket costs $2. It buys for $30 of frozen croissants. You pay a 10% interest rate to your parents for the money they lent to you. Tax rate is 40%. All income and expenses are paid cash (no credit on sale) Show the income statement for the period Sep 1, year n up to Dec 31, year n. a) . now we are said that the company sell S80 cash and $20 on credit It is offered a 4-month delay for paying the marketing expenses and taxes will be paid next year (in year n+1). On Dec 31. you decide to buy a second microwave oven financed with a $150 onc-year loan . Give IS, CF and BS statements from Sept 1 to Dec 31, yearn. b) now we are said that the company sell S40 cash and $60 on credit It is offered a 4-month delay for paying all the marketing expenses and 50% of taxes will be paid next year in year n+1). On Dec 31, you decide to buy a second microwave oven financed with a $150 5-year loan . Give IS, CF and BS statements from Sept I to Dec 31. year n. If a company incurs SIO (pretax) of depreciation expense, how does that affect the three financial statements? A company makes a $100 cash purchase of equipment on Dec. 31. How does this impact the three statements this year and next year? Same question as the previous but the company finances the purchase of equipment by issuing debt rather than paying cash. Continuing with the last question, on Jan. 1 of Year n+3 the equipment breaks and is deemed worthless. The bank calls in the loan. What happens in Year n+3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts