Question: You need to help EIS decide whether to go ahead with the Pathrite system or not. Provide all relevant information and analysis,including a computation of

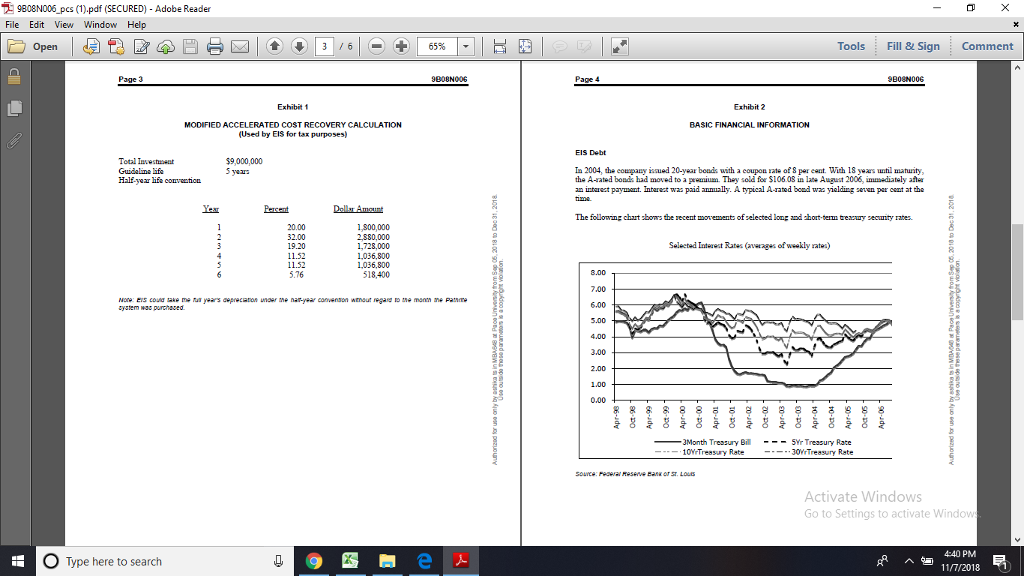

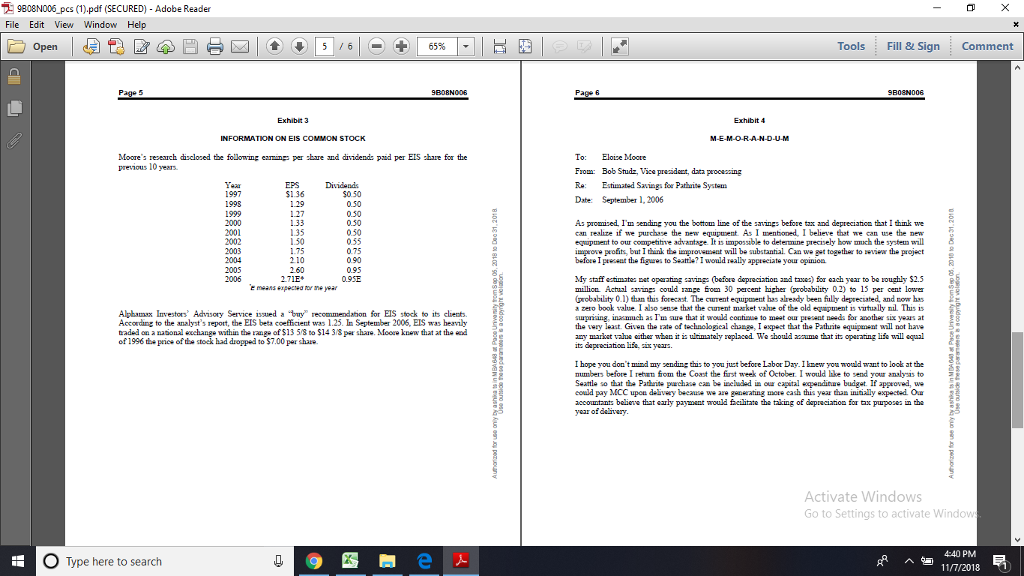

You need to help EIS decide whether to go ahead with the Pathrite system or not. Provide all relevant information and analysis,including a computation of the net present value and internal rate of return of the Pathrite system project. This case is about capital budgeting. However, some of the issues that you will need to grapple with are raised in the modules covering Stock Valuation and Capital Markets. Keep in mind that there is a lot of information in the case: regarding each piece of information, ask yourself whether it's relevant or not and if relevant, how. Keep in mind also that cost of capital is a conceptual quantity that can be measured using several pieces of information. Capital Budgeting is not a mechanistic exercise, not in the forecasting of cashflows and not in the estimation of cost of capital. Note that you should use the weighted average cost of capital formula to compute the cost of capital, viz. WACC = (proportion of equity in the firm's liability structure)(cost of equity capital) + (proportion of debt in the firm's liability structure)(cost of debt capital)(1-marginal tax rate). The write-up should be in Word (with an accompanying Excel spreadsheet showing the computations) You first need to come up with the basic incremental cashflows. That involves simply computing the after-tax earnings year-by-year and adding back depreciation. The treatment of inflation has to be consistent with the discount rate used. You can treat all the cashflows as nominal cashflows, incorporating inflation and then you dont have to do anything about the inflation rate given. However, the constant assumed savings makes that unlikely. So if the savings are treated as savings, unadjusted for inflation, the right thing to do is to inflate the savings at the rate of inflation. However, it is important to keep in mind that tax savings do not increase at the rate of inflation. Also, the discount rate for nominal cashflows has to be a nominal rate, not an inflation-adjusted real rate. The depreciation used in my attached Excel spreadsheet follows the half-year life convention, which says that EIS could start depreciating in year zero, as long as the purchase had occurred in year zero (but I am not necessarily looking for this much sophistication). The key thing in the computation of the discount rate is the realization that there are many ways of computing the cost of equity and the cost of debt. For the cost of debt, the bond yield could be used or the yield on comparably rated bonds could be used. The 8% coupon rate is not the cost of debt unless the debt is sold at par, in which case it would be the yield, as well. For the cost of equity, you can use the CAPM, but that is only one method. You could also use the Gordon growth model formula, which says that r = D/P + g (this will be discussed in more detail in Module 9). You could also look at the actual historical average return. Finally, I expect you to think about sensitivity. Taking the expected cashflows is not recognizing the sensitivity of the realized NPV to the actual cashflows. Looking at the NPV separately under the different scenarios allows us to look at the probability of ending up with a negative realized NPV, which you dont get by simply using the expected cashflows in your computation. please refer the below screenshots of the pdf from Excelerite Integrated Systems, Inc. (EIS) and upload a screenshot of the word file and excel sheet workings.

the following calculations are required along with the MS-Word explanation and computations in excel :

the following calculations are required along with the MS-Word explanation and computations in excel :

| 1-Compute cost of equity |

| |

| 2-Compute debt cost of capital |

| |

| 3-Compute WACC |

| |

| 4-Compute incremental cashflows |

| |

| 5-Depreciation treatment |

| |

| 6-Inflation |

| |

| 7-Sensitivity Analysis |

9B08NO06 pcs (1).pdf (SECURED) Adobe Reader File Edit View Window Help Tools Fill & Sign Comment 65% 9BO8N006 NortheasternRichard lvry Schol of Buins The Laiversily ef Wiewen Onlario Moor did not now the turet capatal structure of EDS or the rdle rate ed by Seattle (ie. the ElS bone office) in evaluating their capital coumatments. Accordingly, she decided to estimate them ing publicly available financial data (see Exhibit 2). She ascmed that ElS maTgement sought to maintain a mux of 30 pe cent long-ten debt and 70 per cantcommmos equity (bock value), whieh was consistent with indushy auwrag. Futtarmore, she lwow that ElS manageneat would be reluctant to sall shaues at the dapessed muiat price of 30 par cnt of bock alue (c Ebit 3), and that the aange ratum on luge company stocks had exceeded the retun on rk-free secies by 6.6 per cent over a 73-year period She estimated hat inflaticn mould average 2.5 per cent each year for the forezeeable fuhue. B08NO EXCELERITE INTEGRATED SYSTEMS, INC. (EIS) A week or s0 after ber conversation with Bob Stadz, Moore received a memorandum from him indicating the expeeted savings frcu the installation ofh equipmeet e Exibit 4She know that ElS would eopact bar analysis to be baced on the application of diseousted cash flow tockniques to detewire both a net paeet vala nd an intaml rate of rohuum Ha ext tak would be to prepe n amnlyciz for Stniz. bacad on the inficauaticn aailable to h etter erectve or ne ectit bandrg of monagew staton dentrying Invormeton taprotect confdentet The autors may have displed ceram names oner 3208(512) 182mal Eloize Moors was elated aa che put don the phone Sta had been ting with Bob Stuz, vice precident data proceing at Excelerite Intagiatad Systems Inc. EIS), who ad juct retumed fom a coupany- poored mnacement developenent progm in late Auguct 2006. Stniz bad saud: Eloise, we had a temrific session on capital budgeting last week. I can now see the uility of peojeeting operating saings cm the Patrite system as a way of peesuading Seate to peovids u with the needed funds I'm daveloping tentative savings mbers and will mmil them to you aa soon a Im finichsd Could you take a rough cut at tha kind of nalyis that will make sence to the Seanle finncial mve Moore was a saerepresentotive nith Manster Computer Coporation MCC) A 12-yeu vetenn, he wa assigned to large accounts, those whose purchaes were expected to exceed $2 million Working from ber office in Phoenix, Arizona, Moore was assigned customers in the westem half of the United States. MCC was the lgast peovidar of hdwae and sottwase in the dasngeld aed had iscently expanded to proride concuiting nd dita procering suices. Moore sw a golden opportity. Seartle was the home ofice for ElS and the source of ll ElS corporate capetal fund If che cld belp Stuiz sell the yztem to his top ragement, sbe wonld enhance ber standing among the sales staMoore sketched out the system that he d Studz had been dscwane It included a supercompater, data storage and a set of peripherals to allow corporate data to be accessed via the Web and by mobile uars in EIS distiet offies around the comtry. The total cost for the system was 9 million Activate Windows Go to Settings to activate Windov Beczraze of the lead time for acembling couponents, deliery and payment cold be in late 2006, 0 Moore decided to uea Jamuzy 1, 2007 operating starting date. She anscipated that the expectedagm tax rate for ETS woald be 40 per cent (federal and state taxe:) and that the modied accelerated cost recovery scheuse for depreciation womld be aed for tax puposes (see Exhubit 1). 4 40 PM O Type here to search 11/7/2018 9B08NO06 pcs (1).pdf (SECURED) Adobe Reader File Edit View Window Help Tools Fill & Sign Comment 65% 9BO8N006 NortheasternRichard lvry Schol of Buins The Laiversily ef Wiewen Onlario Moor did not now the turet capatal structure of EDS or the rdle rate ed by Seattle (ie. the ElS bone office) in evaluating their capital coumatments. Accordingly, she decided to estimate them ing publicly available financial data (see Exhibit 2). She ascmed that ElS maTgement sought to maintain a mux of 30 pe cent long-ten debt and 70 per cantcommmos equity (bock value), whieh was consistent with indushy auwrag. Futtarmore, she lwow that ElS manageneat would be reluctant to sall shaues at the dapessed muiat price of 30 par cnt of bock alue (c Ebit 3), and that the aange ratum on luge company stocks had exceeded the retun on rk-free secies by 6.6 per cent over a 73-year period She estimated hat inflaticn mould average 2.5 per cent each year for the forezeeable fuhue. B08NO EXCELERITE INTEGRATED SYSTEMS, INC. (EIS) A week or s0 after ber conversation with Bob Stadz, Moore received a memorandum from him indicating the expeeted savings frcu the installation ofh equipmeet e Exibit 4She know that ElS would eopact bar analysis to be baced on the application of diseousted cash flow tockniques to detewire both a net paeet vala nd an intaml rate of rohuum Ha ext tak would be to prepe n amnlyciz for Stniz. bacad on the inficauaticn aailable to h etter erectve or ne ectit bandrg of monagew staton dentrying Invormeton taprotect confdentet The autors may have displed ceram names oner 3208(512) 182mal Eloize Moors was elated aa che put don the phone Sta had been ting with Bob Stuz, vice precident data proceing at Excelerite Intagiatad Systems Inc. EIS), who ad juct retumed fom a coupany- poored mnacement developenent progm in late Auguct 2006. Stniz bad saud: Eloise, we had a temrific session on capital budgeting last week. I can now see the uility of peojeeting operating saings cm the Patrite system as a way of peesuading Seate to peovids u with the needed funds I'm daveloping tentative savings mbers and will mmil them to you aa soon a Im finichsd Could you take a rough cut at tha kind of nalyis that will make sence to the Seanle finncial mve Moore was a saerepresentotive nith Manster Computer Coporation MCC) A 12-yeu vetenn, he wa assigned to large accounts, those whose purchaes were expected to exceed $2 million Working from ber office in Phoenix, Arizona, Moore was assigned customers in the westem half of the United States. MCC was the lgast peovidar of hdwae and sottwase in the dasngeld aed had iscently expanded to proride concuiting nd dita procering suices. Moore sw a golden opportity. Seartle was the home ofice for ElS and the source of ll ElS corporate capetal fund If che cld belp Stuiz sell the yztem to his top ragement, sbe wonld enhance ber standing among the sales staMoore sketched out the system that he d Studz had been dscwane It included a supercompater, data storage and a set of peripherals to allow corporate data to be accessed via the Web and by mobile uars in EIS distiet offies around the comtry. The total cost for the system was 9 million Activate Windows Go to Settings to activate Windov Beczraze of the lead time for acembling couponents, deliery and payment cold be in late 2006, 0 Moore decided to uea Jamuzy 1, 2007 operating starting date. She anscipated that the expectedagm tax rate for ETS woald be 40 per cent (federal and state taxe:) and that the modied accelerated cost recovery scheuse for depreciation womld be aed for tax puposes (see Exhubit 1). 4 40 PM O Type here to search 11/7/2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts