Question: You need to prepare for three large, upcoming project expenditures which will begin 4 years from now. The first required cash flow will be

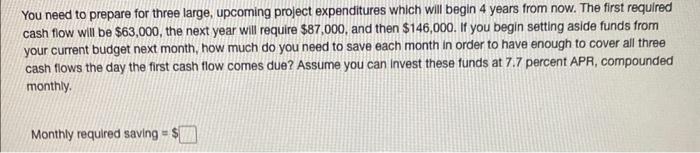

You need to prepare for three large, upcoming project expenditures which will begin 4 years from now. The first required cash flow will be $63,000, the next year will require $87,000, and then $146,000. If you begin setting aside funds from your current budget next month, how much do you need to save each month in order to have enough to cover all three cash flows the day the first cash flow comes due? Assume you can Invest these funds at 7.7 percent APR, compounded monthly. Monthly required saving = $ You need to prepare for three large, upcoming project expenditures which will begin 4 years from now. The first required cash flow will be $63,000, the next year will require $87,000, and then $146,000. If you begin setting aside funds from your current budget next month, how much do you need to save each month in order to have enough to cover all three cash flows the day the first cash flow comes due? Assume you can Invest these funds at 7.7 percent APR, compounded monthly. Monthly required saving = $ You need to prepare for three large, upcoming project expenditures which will begin 4 years from now. The first required cash flow will be $63,000, the next year will require $87,000, and then $146,000. If you begin setting aside funds from your current budget next month, how much do you need to save each month in order to have enough to cover all three cash flows the day the first cash flow comes due? Assume you can Invest these funds at 7.7 percent APR, compounded monthly. Monthly required saving = $

Step by Step Solution

There are 3 Steps involved in it

To determine the monthly savings needed to cover all three cash flows well calculate the present val... View full answer

Get step-by-step solutions from verified subject matter experts