Question: You perform a portfolio attribution analysis on a balanced fund using last years returns in the following table. Column (1) includes the actual return of

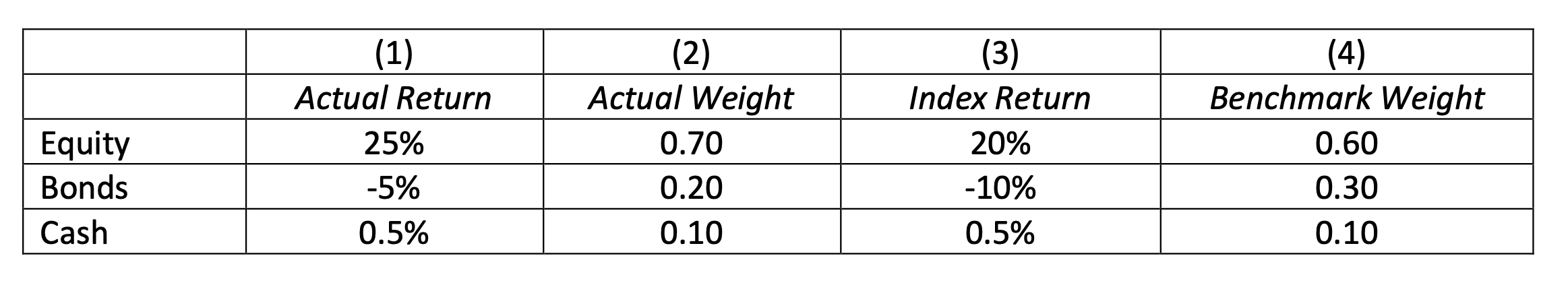

You perform a portfolio attribution analysis on a balanced fund using last years returns in the following table. Column (1) includes the actual return of each asset class in the fund. Column (2) shows the proportion of each asset class in the fund. Column (3) gives the return on the benchmark index of each asset class. Column (4) gives the proportion of each asset class in the benchmark portfolio.

-

(1) Calculate the balanced funds return last year. What was his abnormal performance?

[4 marks]

-

(2) What was the contribution of asset allocation to the managers relative performance?

[5 marks]

-

(3) What was the contribution of security selection to the managers relative performance?

[5 marks]

-

(4) Discuss how using benchmark-adjusted return in step (3) to measure fund managers ability for security selection may cause the low-beta anomaly? Explain. [6 marks]

(1) Actual Return 25% -5% 0.5% Equity Bonds Cash (2) Actual Weight 0.70 0.20 0.10 (3) Index Return 20% -10% 0.5% (4) Benchmark Weight 0.60 0.30 0.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts