Question: You plan to purchase a $220,000 house using a 15-year mortgage obtained from your bank. The mortgage rate offered to you is 4.75 percent. You

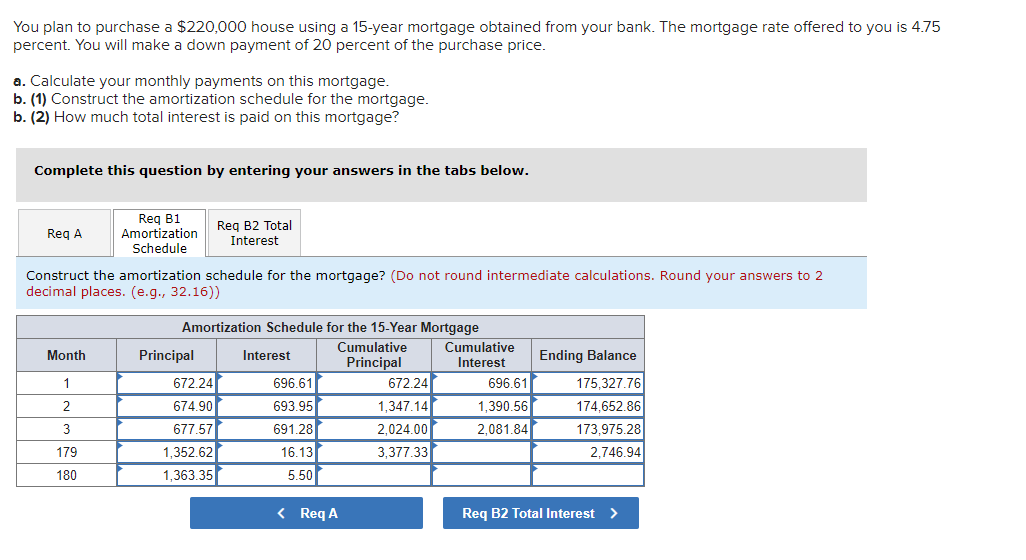

You plan to purchase a $220,000 house using a 15-year mortgage obtained from your bank. The mortgage rate offered to you is 4.75 percent. You will make a down payment of 20 percent of the purchase price. a. Calculate your monthly payments on this mortgage. b. (1) Construct the amortization schedule for the mortgage. b. (2) How much total interest is paid on this mortgage? Complete this question by entering your answers in the tabs below. Req B1 Req B2 Total Reg A Amortization Schedule Interest Construct the amortization schedule for the mortgage? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Month 1 2 Amortization Schedule for the 15-Year Mortgage Cumulative Cumulative Principal Interest Principal Interest Ending Balance 672.24 696.61 672.24 696.61 175,327.76 674.90 693.95 1,347.14 1,390.561 174,652.86 677.57 691.28 2.024.00 2,081.84 173,975.28 1,352.62 16.13 3,377.33 2,746.94 1,363.351 5.50 3 179 180

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts