Question: You plan to purchase a house for $250,000 using a 30 -year mortgage obtained from your local bank. You will make a down payment of

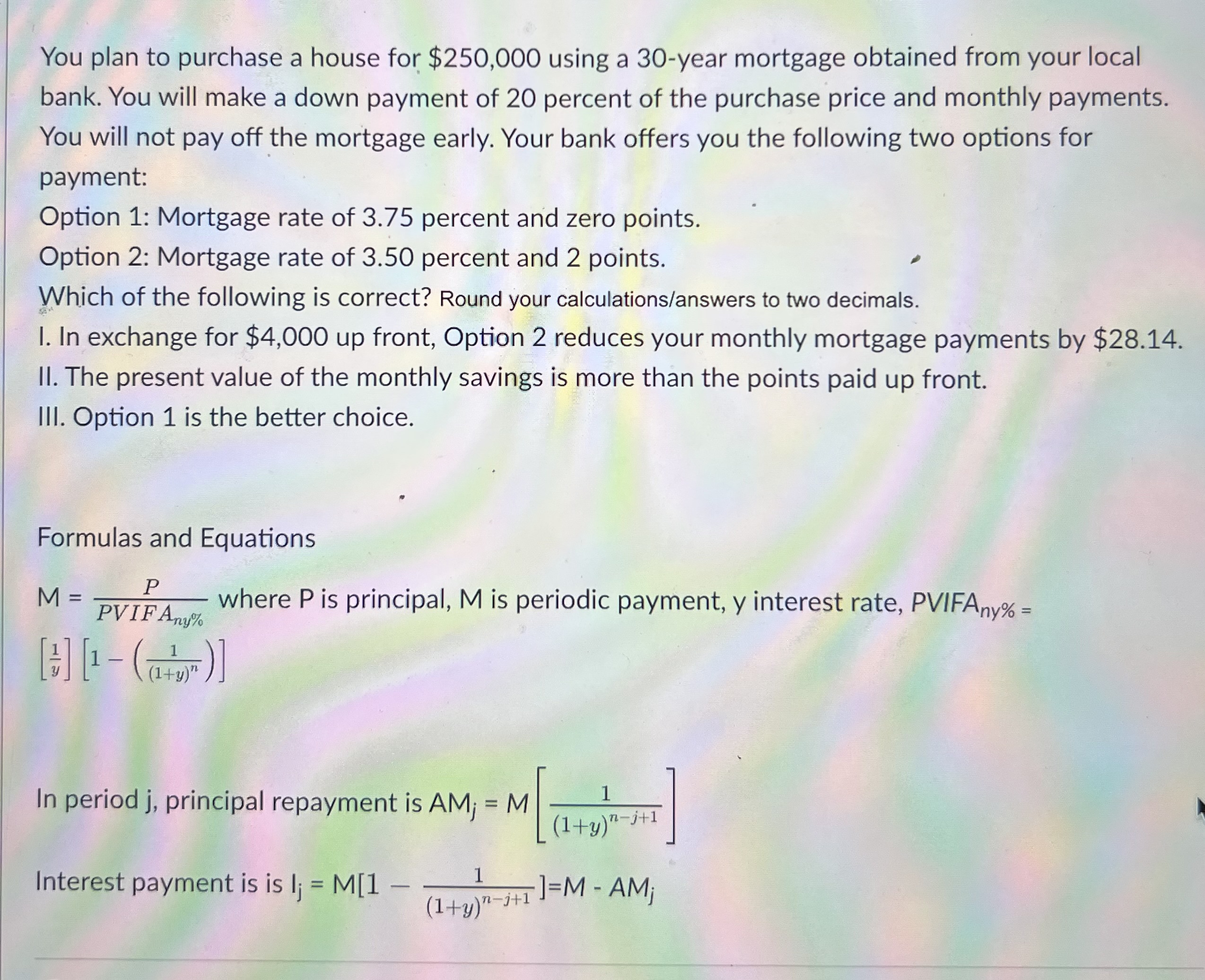

You plan to purchase a house for $250,000 using a 30 -year mortgage obtained from your local bank. You will make a down payment of 20 percent of the purchase price and monthly payments. You will not pay off the mortgage early. Your bank offers you the following two options for payment: Option 1: Mortgage rate of 3.75 percent and zero points. Option 2: Mortgage rate of 3.50 percent and 2 points. Which of the following is correct? Round your calculations/answers to two decimals. I. In exchange for $4,000 up front, Option 2 reduces your monthly mortgage payments by $28.14. II. The present value of the monthly savings is more than the points paid up front. III. Option 1 is the better choice. Formulas and Equations M=PVIFAny%P where P is principal, M is periodic payment, y interest rate, P VIFA Any%= [y1][1((1+y)n1)] In period j, principal repayment is AMj=M[(1+y)nj+11] Interest payment is is Ij=M[1(1+y)nj+11]=MAMj

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts