Question: You plan to put $10,000 in a saving plan for 2 years. How much will you have at the end of 2 years with

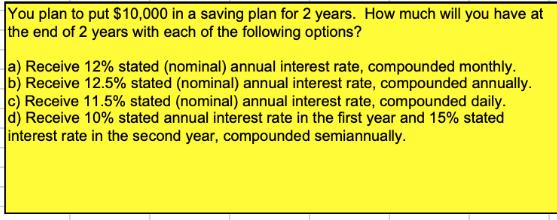

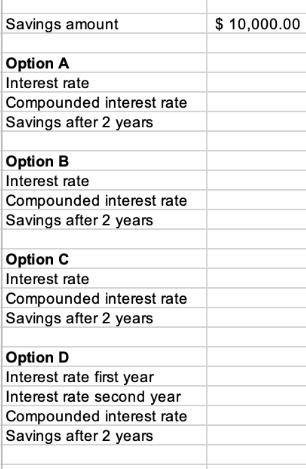

You plan to put $10,000 in a saving plan for 2 years. How much will you have at the end of 2 years with each of the following options? a) Receive 12% stated (nominal) annual interest rate, compounded monthly. b) Receive 12.5% stated (nominal) annual interest rate, compounded annually. c) Receive 11.5% stated (nominal) annual interest rate, compounded daily. d) Receive 10% stated annual interest rate in the first year and 15% stated interest rate in the second year, compounded semiannually. Savings amount Option A Interest rate Compounded interest rate Savings after 2 years Option B Interest rate Compounded interest rate Savings after 2 years Option C Interest rate Compounded interest rate Savings after 2 years Option D Interest rate first year Interest rate second year Compounded interest rate Savings after 2 years $ 10,000.00

Step by Step Solution

3.59 Rating (152 Votes )

There are 3 Steps involved in it

To calculate the future value of an investment you can use the compound interest formula A P 1 ... View full answer

Get step-by-step solutions from verified subject matter experts