Question: You plan to start saving for your retirement next year. You will save $5,000 for the 40 years you will be working. When you

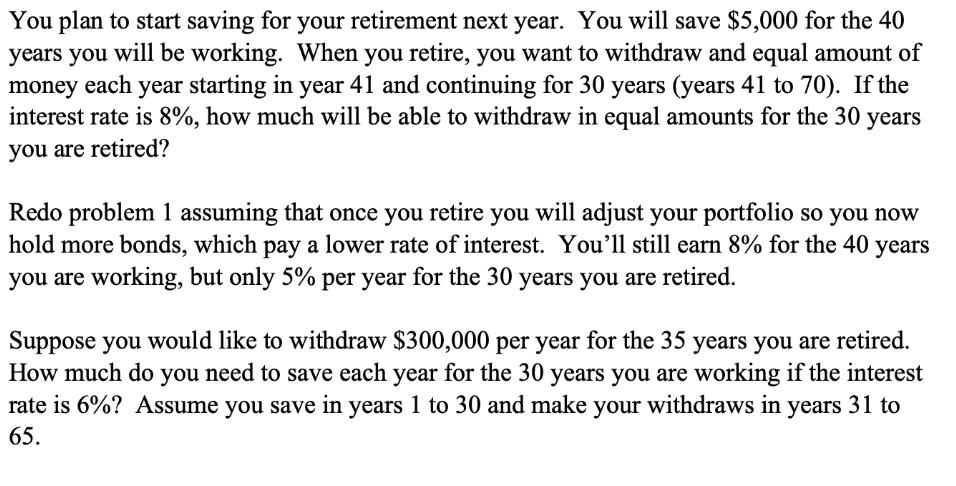

You plan to start saving for your retirement next year. You will save $5,000 for the 40 years you will be working. When you retire, you want to withdraw and equal amount of money each year starting in year 41 and continuing for 30 years (years 41 to 70). If the interest rate is 8%, how much will be able to withdraw in equal amounts for the 30 years you are retired? Redo problem 1 assuming that once you retire you will adjust your portfolio so you now hold more bonds, which pay a lower rate of interest. You'll still earn 8% for the 40 years you are working, but only 5% per year for the 30 years you are retired. Suppose you would like to withdraw $300,000 per year for the 35 years you are retired. How much do you need to save each year for the 30 years you are working if the interest rate is 6%? Assume you save in years 1 to 30 and make your withdraws in years 31 to 65.

Step by Step Solution

There are 3 Steps involved in it

4949763 per year Step 1 Calculate the future value of the savings after 40 year... View full answer

Get step-by-step solutions from verified subject matter experts