Question: You are trying to prepare nancial statements for Bartlett Pickle Company, but seem to be missing its balance sheet. You have Bartletts income statement, which

You are trying to prepare financial statements for Bartlett Pickle Company, but seem to be missing its balance sheet. You have Bartlett’s income statement, which shows sales last year were $310 million with a gross profit margin of 40 percent. You also know that credit sales equaled three-quarters of Bartlett’s total revenues last year. In addition, Bartlett had a collection period of 45 days, a payables period of 35 days, and an inventory turnover of 10 times based on cost of goods sold. Calculate Bartlett’s year-ending balance for accounts receivable, inventory, and accounts payable.

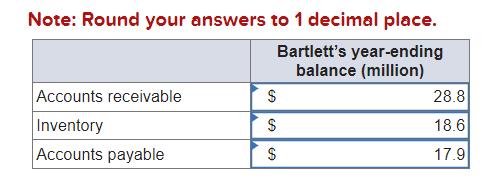

Note: Round your answers to 1 decimal place.

Is the answer above correct??

Problem 2-10

In 2020, Natural Selection, a nationwide computer dating service, had $532 million of assets and $216 million of liabilities. Earnings before interest and taxes were $136 million, interest expense was $29.5 million, the tax rate was 40 percent, principal repayment requirements were $25.6 million, and annual dividends were 35 cents per share on 22 million shares outstanding. Calculate the following for Natural Selection:

liability to Equity Ratio

Times Interest-earned ratio

Times Burden Covered Note: Round your answers to 2 decimal places.

What percentage decline in earnings before interest and taxes could Natural Selection have sustained before failing to cover: calculate Interest payment requirements? Principle and interest requirements? Principle, interest, and common dividends payments Note: Round your answers to 1 decimal place.

| Problem 2-7 | ||||||||||||||

| Answer the following questions based on the information in the table. Assume a tax rate of 30 percent. For simplicity, assume that the companies have no other liabilities other than the debt shown. (All dollars are in millions.) | ||||||||||||||

| Atlantic Corporation | Pacific Corporation | |||||||||||||

| Earnings before interest and taxes | $440 | $520 | ||||||||||||

| Debt (at 7% interest) | $290 | $1,540 | ||||||||||||

| Equity | $960 | $370 | ||||||||||||

| a. Calculate each company’s ROE, ROA, and ROIC. | ||||||||||||||

| Note: Round your answers to 1 decimal place. | ||||||||||||||

Problem 2-5

Selected financial data for Amberjack Corporation follows.

| Year 1 ($ thousands) | Year 2 ($ thousands) | |

|---|---|---|

| Sales | 336,243 | 474,019 |

| Cost of goods sold | 262,246 | 354,464 |

| Net income | (168,099) | (404,809) |

| Cash flow from operations | (60,503) | (22,946) |

| Cash | 342,480 | 270,497 |

| Marketable securities | 343,374 | 38,200 |

| Accounts receivable | 22,584 | 36,923 |

| Inventories | 6,642 | 73,406 |

| Total current assets | 715,080 | 419,026 |

| Accounts payable | 30,208 | 24,058 |

| Accrued liabilities | 45,922 | 126,151 |

| Total current liabilities | 76,130 | 150,209 |

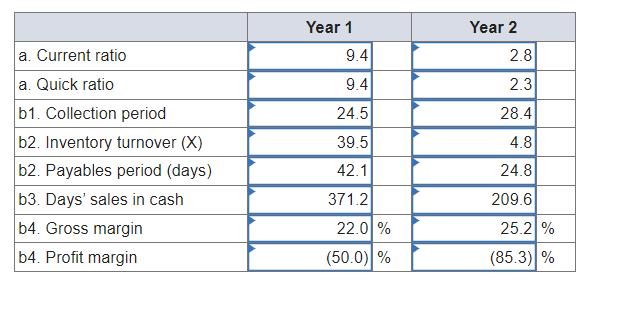

Calculate the current and quick ratio at the end of each year.

Note: Round your answers to 1 decimal place.

Assuming a 365-day year for all calculations, compute the following:

- The collection period each year based on sales.

- The inventory turnover and the payables period each year based on cost of goods sold.

- The days’ sales in cash each year.

- The gross margin and profit margin each year.

Note: Round your answers to 1 decimal place. Negative answers should be indicated by parentheses.

Is the previous calculation correct? Especially quick ratio year 2 and collection period year 1 & 2, days in sales in cash year 1&2 and profit margin year 1 &2 Thank you

Note: Round your answers to 1 decimal place. Bartlett's year-ending balance (million) Accounts receivable Inventory Accounts payable $ $ $ CA 28.8 18.6 17.9

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Problem 29 To calculate Bartletts yearending balance for accounts receivable inventory and accounts payable we can use the following formulas 1 Accounts Receivable Accounts Receivable Credit Sales 365 ... View full answer

Get step-by-step solutions from verified subject matter experts