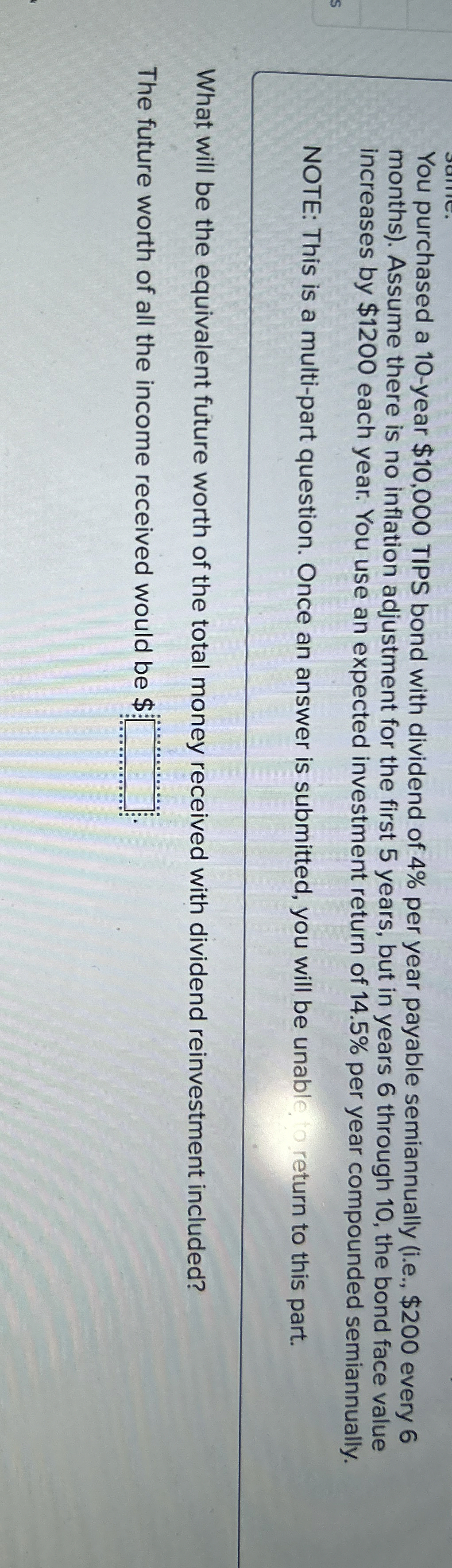

Question: You purchased a 1 0 - year $ 1 0 , 0 0 0 TIPS bond with dividend of 4 % per year payable semiannually

You purchased a year $ TIPS bond with dividend of per year payable semiannually ie $ every

months Assume there is no inflation adjustment for the first years, but in years through the bond face value

increases by $ each year. You use an expected investment return of per year compounded semiannually.

NOTE: This is a multipart question. Once an answer is submitted, you will be unable return to this part.

What will be the equivalent future worth of the total money received with dividend reinvestment included?

The future worth of all the income received would be $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock