Question: You purchased a commercial office building for $2,200,000 one year ago. The appraisal noted the value of the land was worth $550,000. You financed the

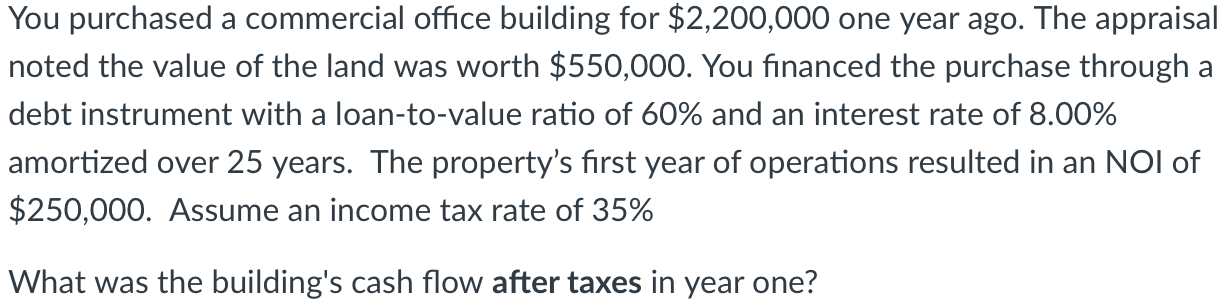

You purchased a commercial office building for $2,200,000 one year ago. The appraisal noted the value of the land was worth $550,000. You financed the purchase through a debt instrument with a loan-to-value ratio of 60% and an interest rate of 8.00% amortized over 25 years. The property's first year of operations resulted in an NOI of $250,000. Assume an income tax rate of 35% What was the building's cash flow after taxes in year one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts