Question: You really need to draw a timeline for this problem. Today is your 40th birthday. You expect to retire at age 65 and actuarial tables

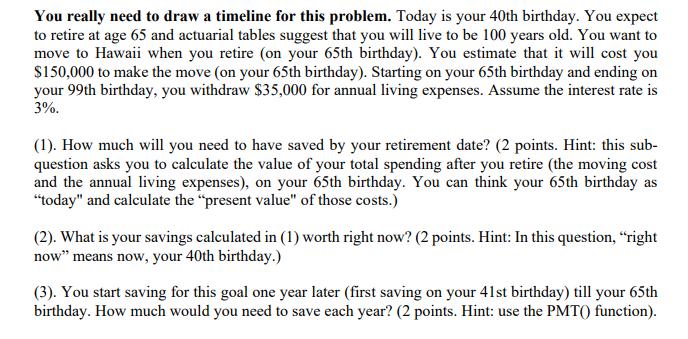

You really need to draw a timeline for this problem. Today is your 40th birthday. You expect to retire at age 65 and actuarial tables suggest that you will live to be 100 years old. You want to move to Hawaii when you retire on your 65th birthday). You estimate that it will cost you $150,000 to make the move on your 65th birthday). Starting on your 65th birthday and ending on your 99th birthday, you withdraw $35,000 for annual living expenses. Assume the interest rate is 3%. (1). How much will you need to have saved by your retirement date? (2 points. Hint: this sub- question asks you to calculate the value of your total spending after you retire (the moving cost and the annual living expenses), on your 65th birthday. You can think your 65th birthday as "today" and calculate the present value" of those costs.) (2). What is your savings calculated in (1) worth right now? (2 points. Hint: In this question, right now" means now, your 40th birthday.) (3). You start saving for this goal one year later (first saving on your 41st birthday) till your 65th birthday. How much would you need to save each year? (2 points. Hint: use the PMT() function)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts