Question: - You received partial credit in the previous attempt. A new electronic process monitor costs $990,000. This cost could be depreciated at 30% per year

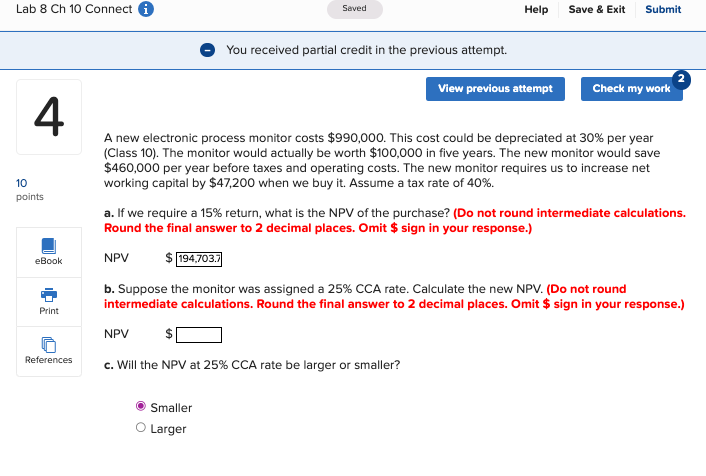

- You received partial credit in the previous attempt. A new electronic process monitor costs $990,000. This cost could be depreciated at 30% per year (Class 10). The monitor would actually be worth $100,000 in five years. The new monitor would save $460,000 per year before taxes and operating costs. The new monitor requires us to increase net working capital by $47,200 when we buy it. Assume a tax rate of 40%. a. If we require a 15% return, what is the NPV of the purchase? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $ b. Suppose the monitor was assigned a 25% CCA rate. Calculate the new NPV. (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $ c. Will the NPV at 25% CCA rate be larger or smaller? Smaller Larger - You received partial credit in the previous attempt. A new electronic process monitor costs $990,000. This cost could be depreciated at 30% per year (Class 10). The monitor would actually be worth $100,000 in five years. The new monitor would save $460,000 per year before taxes and operating costs. The new monitor requires us to increase net working capital by $47,200 when we buy it. Assume a tax rate of 40%. a. If we require a 15% return, what is the NPV of the purchase? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $ b. Suppose the monitor was assigned a 25% CCA rate. Calculate the new NPV. (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $ c. Will the NPV at 25% CCA rate be larger or smaller? Smaller Larger

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts