Question: - You received partial credit in the previous attempt. Problem 7-32 Stock Valuation [LO 1] Most corporations pay quarterly dividends on their common stock rather

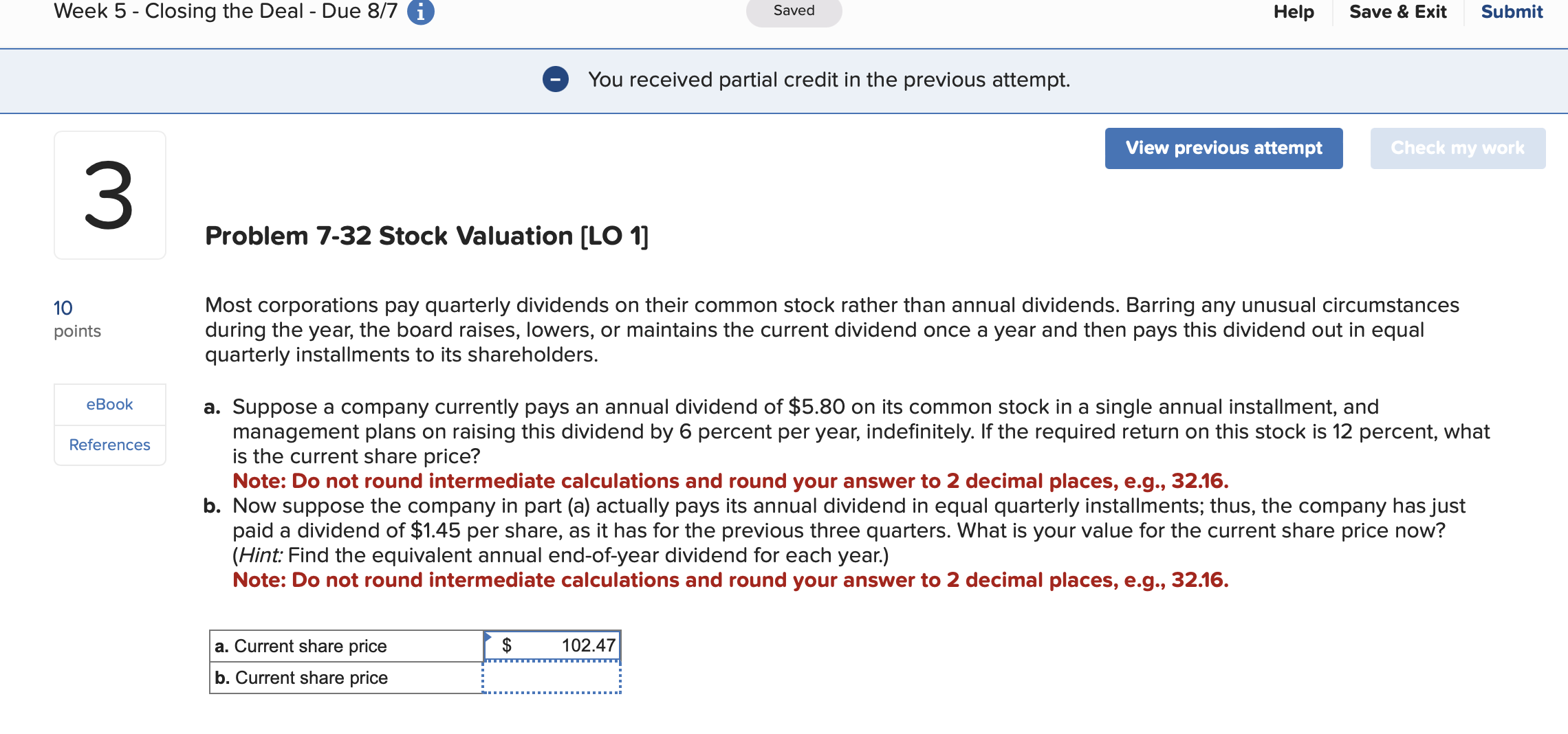

- You received partial credit in the previous attempt. Problem 7-32 Stock Valuation [LO 1] Most corporations pay quarterly dividends on their common stock rather than annual dividends. Barring any unusual circumstances during the year, the board raises, lowers, or maintains the current dividend once a year and then pays this dividend out in equal quarterly installments to its shareholders. a. Suppose a company currently pays an annual dividend of $5.80 on its common stock in a single annual installment, and management plans on raising this dividend by 6 percent per year, indefinitely. If the required return on this stock is 12 percent, what is the current share price? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. Now suppose the company in part (a) actually pays its annual dividend in equal quarterly installments; thus, the company has just paid a dividend of $1.45 per share, as it has for the previous three quarters. What is your value for the current share price now? (Hint: Find the equivalent annual end-of-year dividend for each year.) Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts