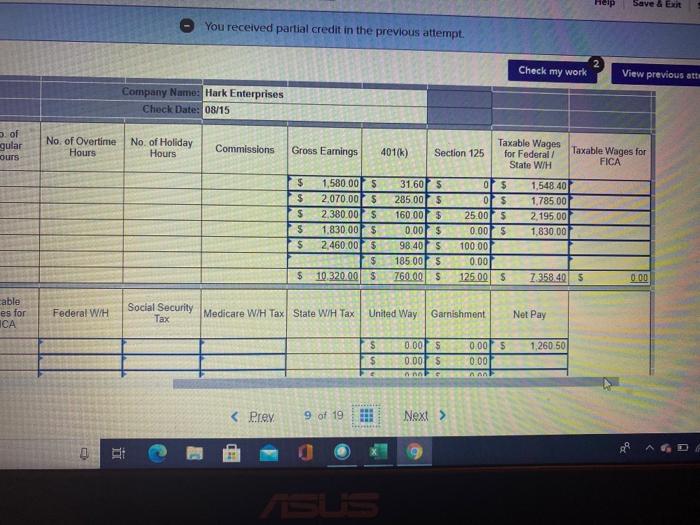

Question: You received partial credit in the previous attempt View pre Check my work Required: Calculate the net pay from the information provided below for the

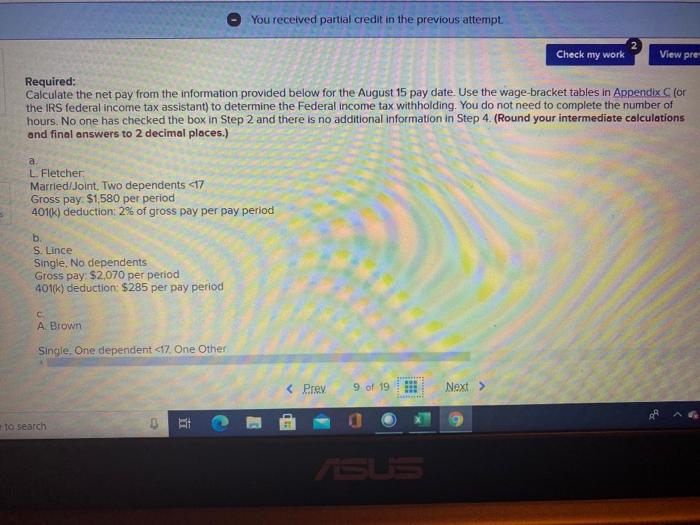

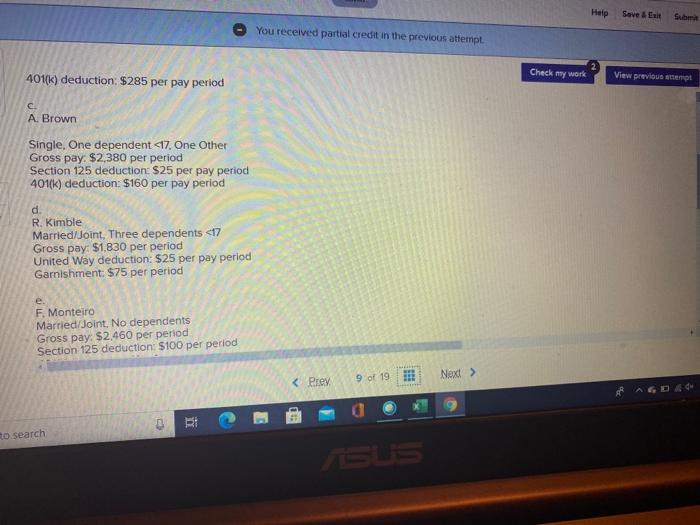

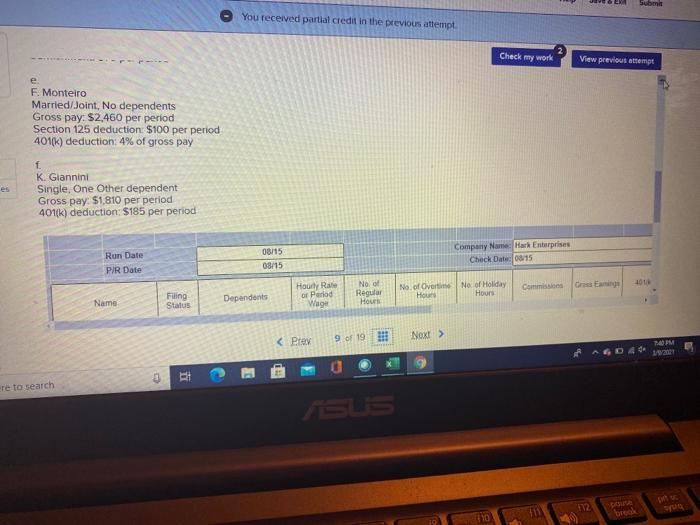

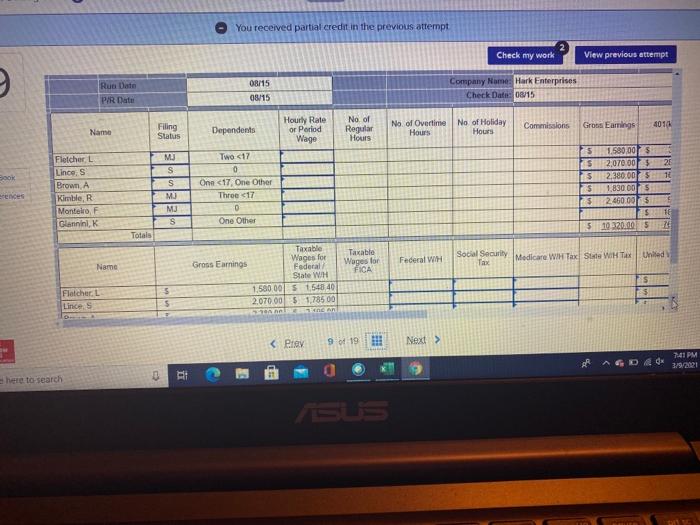

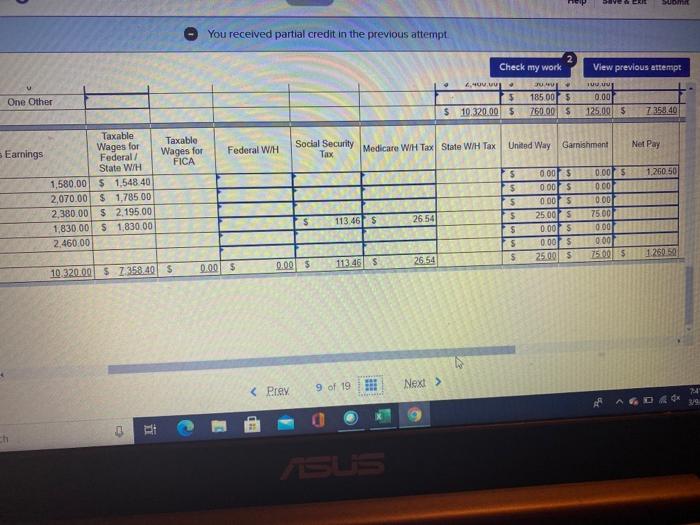

You received partial credit in the previous attempt View pre Check my work Required: Calculate the net pay from the information provided below for the August 15 pay date. Use the wage bracket tables in Appendix (or the IRS federal income tax assistant) to determine the Federal income tax withholding. You do not need to complete the number of hours. No one has checked the box in Step 2 and there is no additional information in Step 4. (Round your intermediate calculations and final answers to 2 decimal places.) a L. Fletcher Married/Joint, Two dependents 2 to search Submit You received partial credit in the previous attempt Check my work View previous attempt F. Monteiro Married/Joint, No dependents Gross pay: $2.460 per period Section 125 deduction: $100 per period 401(K) deduction: 4% of gross pay f K. Giannini Single, One Other dependent Gross pay: $1,810 per period 401(k) deduction: $185 per period Run Date PIR Date 08/15 08/15 Company Name Hard Enterprises Check Date 08/15 No. of Over Hou Commis Hourly Rae or Period Wage No. of Holiday Hour Noo Regular Hous Filing Status Dependents Name 7:40 PM ere to search 12 treck You received partial credit in the previous attempt Check my work View previous attempt 08/15 Run Date PR Datu Company Name: Hark Enterprises Check Dan 0015 08/15 Dependents Hourly Rate or Period Wage No. of Regular Hours Filing Status Name No. of Overtime Hours No of Holiday Hours Commissions Gross Earrings 4010 MJ S 20 10 Fletcher L Linco. S Brown A Kimble, Monteiro F Glannini, 1.580,00 $ $ 2,070005 $ 2,380.00 $ 1.830.00 5 2.460.00 5 Two at Suo You received partial credit in the previous attempt Check my work 4,40 M $ 185 005 $10.320.00 $ 760.00 $ View previous attempt 10. 0.00 125,00 $ 7358.40 One Other Taxable Wages for FICA Net Pay Federal W/H Social Security Medicare WH Tax State WIH Tax United Way Garnishment Tax 1,260.50 Taxable Earnings Wages for Federal / State W/H 1,580.00 $ 1,548.40 2,070.00 $ 1,785 00 2,380.00 $ 2.195.00 1,830.00 S 1.830.00 2.460.00 5 $ 5 5 5 $ 0.00 $ 0.00 $ 0.001s 2500 5 0.00 $ 0.005 25.00 $ 0.00 5 0.001 0.001 75.00 000 000 75.00 5 $ 26.54 113.46 $ 1.260.59 $ 0.00 $ 0.005 26.54 113.46 10 320.005 7358.40 $ 9 of 19 24" ch You received partial credit in the previous attempt View pre Check my work Required: Calculate the net pay from the information provided below for the August 15 pay date. Use the wage bracket tables in Appendix (or the IRS federal income tax assistant) to determine the Federal income tax withholding. You do not need to complete the number of hours. No one has checked the box in Step 2 and there is no additional information in Step 4. (Round your intermediate calculations and final answers to 2 decimal places.) a L. Fletcher Married/Joint, Two dependents 2 to search Submit You received partial credit in the previous attempt Check my work View previous attempt F. Monteiro Married/Joint, No dependents Gross pay: $2.460 per period Section 125 deduction: $100 per period 401(K) deduction: 4% of gross pay f K. Giannini Single, One Other dependent Gross pay: $1,810 per period 401(k) deduction: $185 per period Run Date PIR Date 08/15 08/15 Company Name Hard Enterprises Check Date 08/15 No. of Over Hou Commis Hourly Rae or Period Wage No. of Holiday Hour Noo Regular Hous Filing Status Dependents Name 7:40 PM ere to search 12 treck You received partial credit in the previous attempt Check my work View previous attempt 08/15 Run Date PR Datu Company Name: Hark Enterprises Check Dan 0015 08/15 Dependents Hourly Rate or Period Wage No. of Regular Hours Filing Status Name No. of Overtime Hours No of Holiday Hours Commissions Gross Earrings 4010 MJ S 20 10 Fletcher L Linco. S Brown A Kimble, Monteiro F Glannini, 1.580,00 $ $ 2,070005 $ 2,380.00 $ 1.830.00 5 2.460.00 5 Two at Suo You received partial credit in the previous attempt Check my work 4,40 M $ 185 005 $10.320.00 $ 760.00 $ View previous attempt 10. 0.00 125,00 $ 7358.40 One Other Taxable Wages for FICA Net Pay Federal W/H Social Security Medicare WH Tax State WIH Tax United Way Garnishment Tax 1,260.50 Taxable Earnings Wages for Federal / State W/H 1,580.00 $ 1,548.40 2,070.00 $ 1,785 00 2,380.00 $ 2.195.00 1,830.00 S 1.830.00 2.460.00 5 $ 5 5 5 $ 0.00 $ 0.00 $ 0.001s 2500 5 0.00 $ 0.005 25.00 $ 0.00 5 0.001 0.001 75.00 000 000 75.00 5 $ 26.54 113.46 $ 1.260.59 $ 0.00 $ 0.005 26.54 113.46 10 320.005 7358.40 $ 9 of 19 24" ch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts