Question: You run a contract research organization ( CRO ) and rely heavily on government contracts for your revenue. A new request for proposals ( RFP

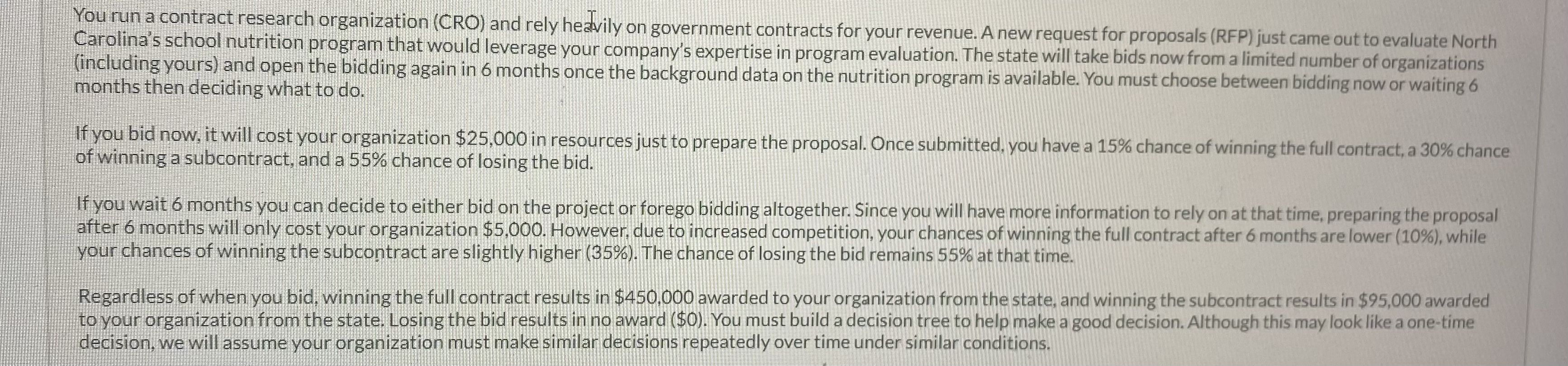

You run a contract research organization CRO and rely heavily on government contracts for your revenue. A new request for proposals RFP just came out to evaluate North Carolina's school nutrition program that would leverage your company's expertise in program evaluation. The state will take bids now from a limited number of organizations including yours and open the bidding again in months once the background data on the nutrition program is available. You must choose between bidding now or waiting months then deciding what to do

If you bid now, it will cost your organization $ in resources just to prepare the proposal. Once submitted, you have a chance of winning the full contract, a chance of winning a subcontract, and a chance of losing the bid.

If you wait months you can decide to either bid on the project or forego bidding altogether. Since you will have more information to rely on at that time, preparing the proposal after months will only cost your organization $ However, due to increased competition, your chances of winning the full contract after months are lower while your chances of winning the subcontract are slightly higher The chance of losing the bid remains at that time.

Regardless of when you bid, winning the full contract results in $ awarded to your organization from the state, and winning the subcontract results in $ awarded to your organization from the state. Losing the bid results in no award $ You must build a decision tree to help make a good decision. Although this may look like a onetime

decision, we will assume your organization must make similar decisions repeatedly over time under similar conditions.

How many terminal nodea are there in this problem? Show in excel.

How many event nodes are there in this problem? Show in excel.

What value would a payoff matrix indicate based on budding now and winning the subcontract? Show in excel.

If you choose to wait months, what is the expected konetary value of deciding to forego bidding altogether? Show in excel.

What is the expected monetary vlaue of bidding now? Show in excel.

What is the expected konetary value of waiting months then bidding? Show in excel.

What dollar value emv separates the decision to bid now from the decision to wait months? Show in excel.

What course of action would you take based off the decision tree?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock