Question: You source Ice Cubes to sell in the US from an Eskimo village and you owe them 4,000,000 Danish Kronas (DKK), which is due

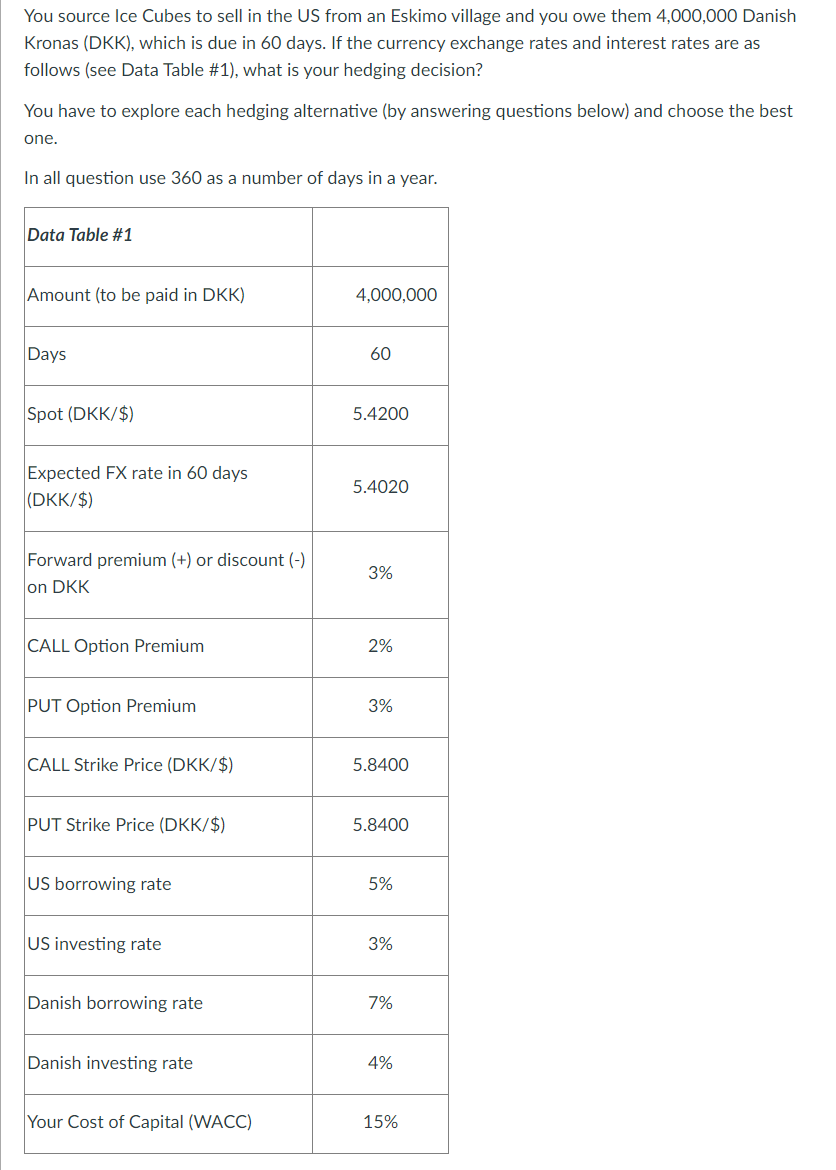

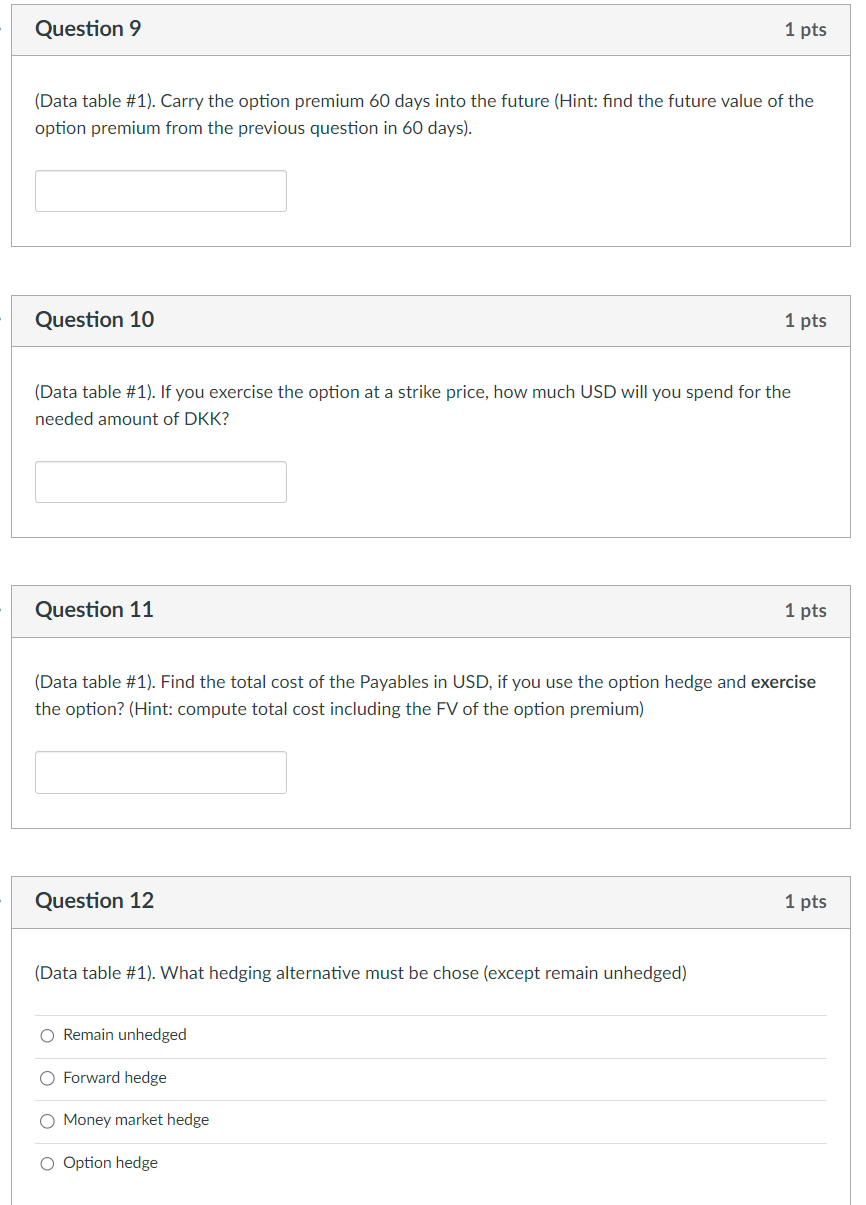

You source Ice Cubes to sell in the US from an Eskimo village and you owe them 4,000,000 Danish Kronas (DKK), which is due in 60 days. If the currency exchange rates and interest rates are as follows (see Data Table #1), what is your hedging decision? You have to explore each hedging alternative (by answering questions below) and choose the best one. In all question use 360 as a number of days in a year. Data Table #1 Amount (to be paid in DKK) Days Spot (DKK/$) Expected FX rate in 60 days (DKK/$) Forward premium (+) or discount (-) on DKK CALL Option Premium PUT Option Premium CALL Strike Price (DKK/$) PUT Strike Price (DKK/$) US borrowing rate US investing rate Danish borrowing rate Danish investing rate Your Cost of Capital (WACC) 4,000,000 60 5.4200 5.4020 3% 2% 3% 5.8400 5.8400 5% 3% 7% 4% 15% Question 9 (Data table #1). Carry the option premium 60 days into the future (Hint: find the future value of the option premium from the previous question in 60 days). Question 10 Question 11 (Data table #1). If you exercise the option at a strike price, how much USD will you spend for the needed amount of DKK? 1 pts Question 12 (Data table #1). What hedging alternative must be chose (except remain unhedged) 1 pts (Data table #1). Find the total cost of the Payables in USD, if you use the option hedge and exercise the option? (Hint: compute total cost including the FV of the option premium) O Remain unhedged O Forward hedge O Money market hedge O Option hedge 1 pts 1 pts

Step by Step Solution

3.27 Rating (156 Votes )

There are 3 Steps involved in it

Answers To evaluate the hedging alternatives and determine the best one we need to calculate the costs and benefits associated with each option Lets g... View full answer

Get step-by-step solutions from verified subject matter experts