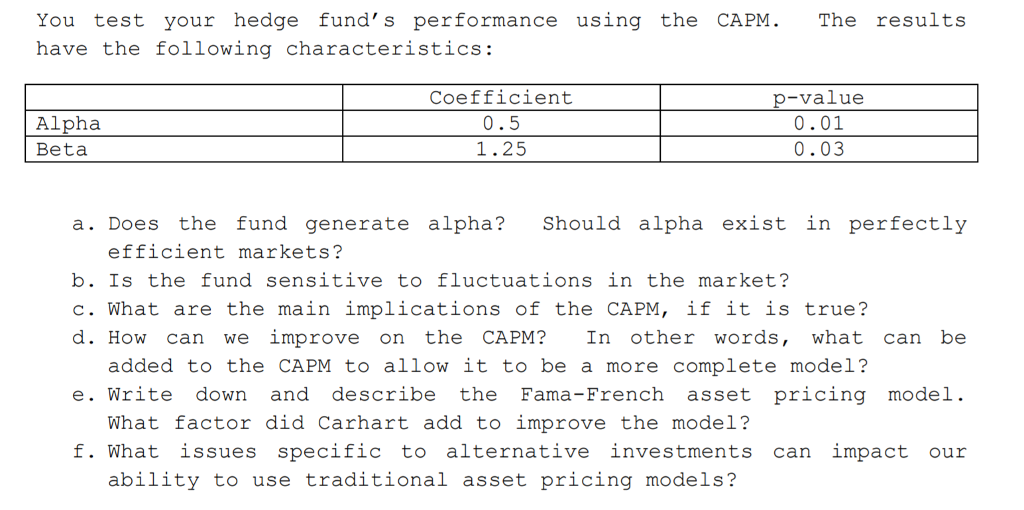

Question: You test your hedge fund' s performance using the CAPM. The results have the following characteristics: Alpha Beta Coefficient 0.5 1.25 p-value 0.01 0.03 a.

You test your hedge fund' s performance using the CAPM. The results have the following characteristics: Alpha Beta Coefficient 0.5 1.25 p-value 0.01 0.03 a. Does the fund generate alpha? Should alpha exist in perfectly efficient markets? b. Is the fund sensitive to fluctuations in the market? c. What are the main implications of the CAPM, if it is true? d. How can we improve on the CAPM? In other words, what can be added to the CAPM to allow it to be a more complete model? e. Write down and describe the Fama-French asset pricing model. What factor did Carhart add to improve the model? f. What issues specific to alternative investments can impact our ability to use traditional asset pricing models

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts