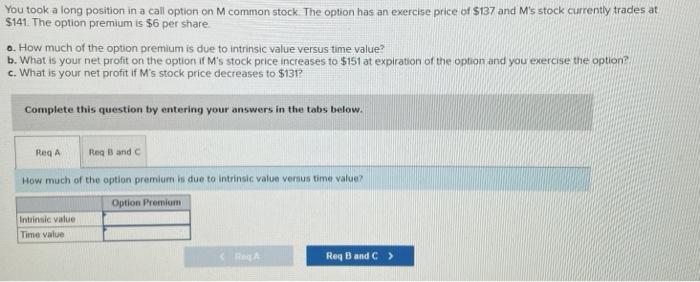

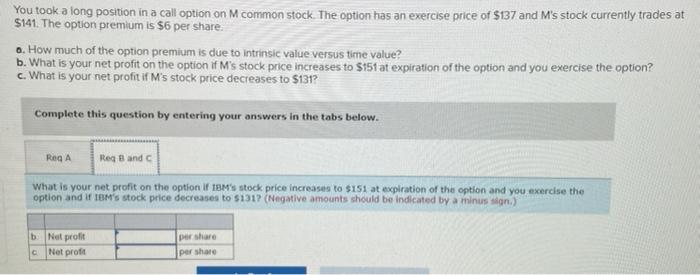

Question: You took a long position in a call option on M common stock. The option has an exercise price of $137 and M's stock currently

You took a long position in a call option on M common stock. The option has an exercise price of $137 and M's stock currently trades at $141. The option premium is $6 per share o. How much of the option premium is due to intrinsic value versus time value? b. What is your net profit on the option it M's stock price increases to $151 at expiration of the option and you exercise the option? c. What is your net profit if M's stock price decreases to $131 Complete this question by entering your answers in the tabs below. ReqA Req Band How much of the option premium is due to intrinsic value versus time value? Option Premium Intrinsic value Time value Bagh Reg Band > $141. The option premium is $6 per share. You took a long position in a call option on M common stock. The option has an exercise price of $137 and M's stock currently trades at o. How much of the option premium is due to intrinsic value versus time value? b. What is your net profit on the option if M's stock price increases to $151 at expiration of the option and you exercise the option? c. What is your net profit if M's stock price decreases to $1312 Complete this question by entering your answers in the tabs below. ROGA Red Band What is your net profit on the option f 18M's stock price increases to $151 at expiration of the option and you exercise the option and if IBM's stock price decreases to $131? (Negative amounts should be indicated by a minus sign) bNet profit C Net profit per share per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts