Question: You use a binomial interest rate model to evaluate a 7.5% interest rate cap on a $100 three-year loan. You are given: The interest rates

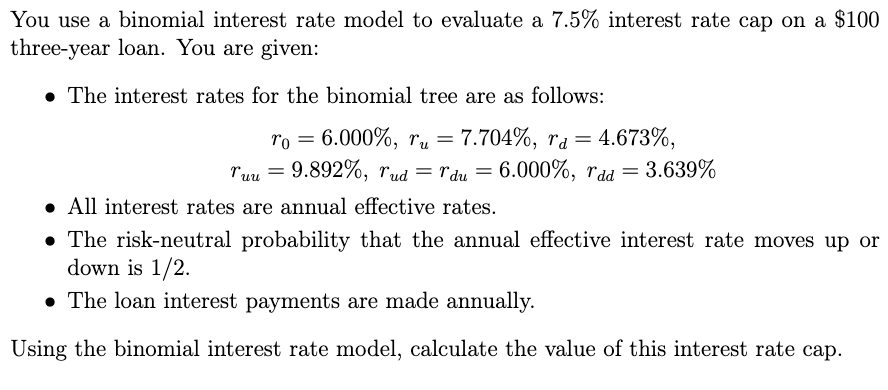

You use a binomial interest rate model to evaluate a 7.5% interest rate cap on a $100 three-year loan. You are given: The interest rates for the binomial tree are as follows: ro = 6.000%, ru= 7.704%, Ta = 4.673%, Puu = 9.892%, rud = r du = 6.000%, rad = 3.639% All interest rates are annual effective rates. The risk-neutral probability that the annual effective interest rate moves up or down is 1/2. The loan interest payments are made annually. Using the binomial interest rate model, calculate the value of this interest rate cap. You use a binomial interest rate model to evaluate a 7.5% interest rate cap on a $100 three-year loan. You are given: The interest rates for the binomial tree are as follows: ro = 6.000%, ru= 7.704%, Ta = 4.673%, Puu = 9.892%, rud = r du = 6.000%, rad = 3.639% All interest rates are annual effective rates. The risk-neutral probability that the annual effective interest rate moves up or down is 1/2. The loan interest payments are made annually. Using the binomial interest rate model, calculate the value of this interest rate cap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts