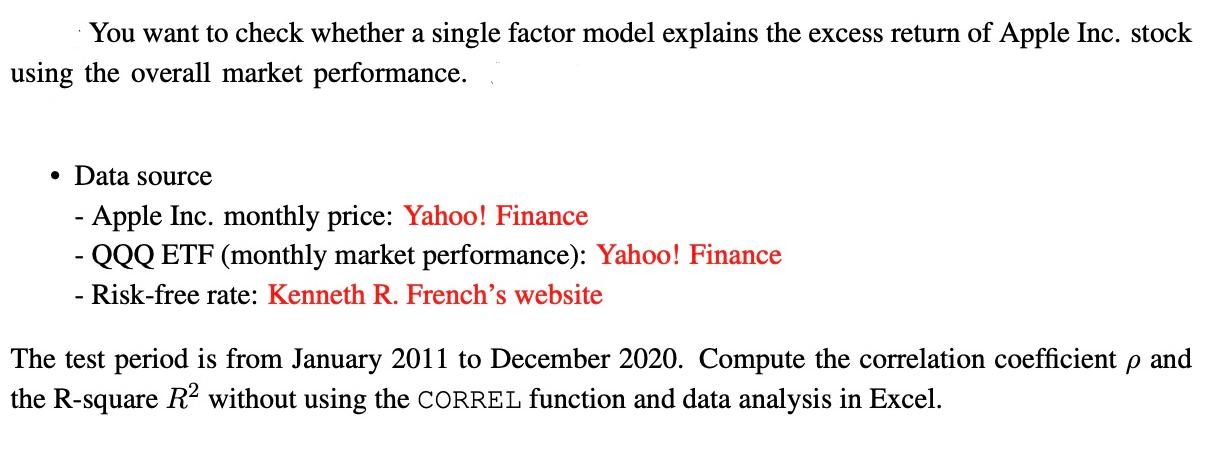

Question: You want to check whether a single factor model explains the excess return of Apple Inc. stock using the overall market performance. Data source

You want to check whether a single factor model explains the excess return of Apple Inc. stock using the overall market performance. Data source - Apple Inc. monthly price: Yahoo! Finance - QQQ ETF (monthly market performance): Yahoo! Finance Risk-free rate: Kenneth R. French's website The test period is from January 2011 to December 2020. Compute the correlation coefficient p and the R-square R without using the CORREL function and data analysis in Excel.

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

You want to check whether a single factor model explains the excess return of Apple Inc ... View full answer

Get step-by-step solutions from verified subject matter experts