Question: You will be attending an MBA program that will require paying $11,000 a year in tuition expenses at the end of the year for 2

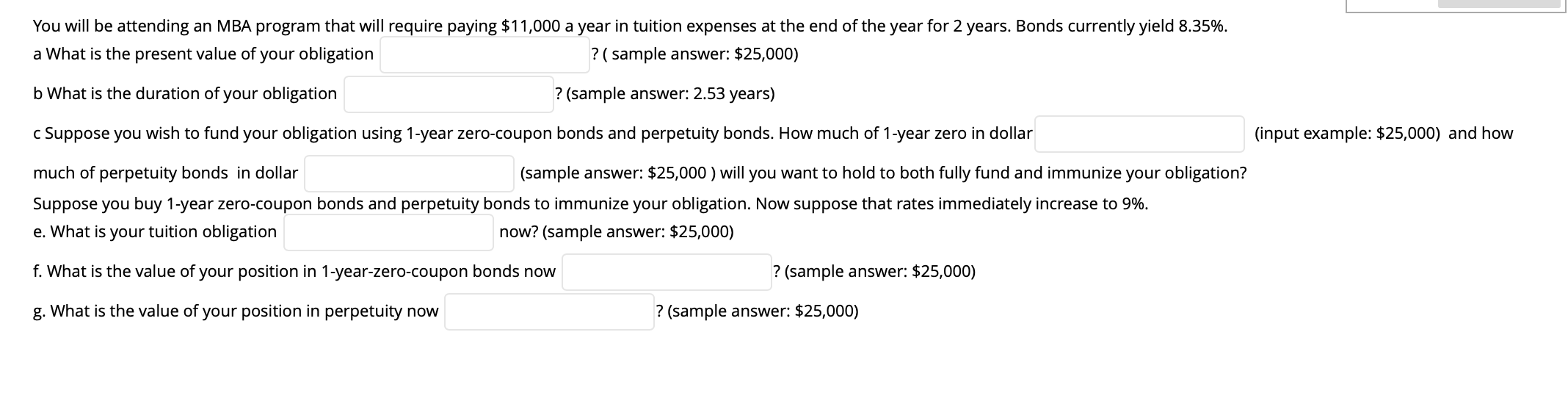

You will be attending an MBA program that will require paying $11,000 a year in tuition expenses at the end of the year for 2 years. Bonds currently yield 8.35%. a What is the present value of your obligation ? ( sample answer: $25,000) b What is the duration of your obligation ? (sample answer: 2.53 years) c Suppose you wish to fund your obligation using 1-year zero-coupon bonds and perpetuity bonds. How much of 1-year zero in dollar (input example: $25,000) and how much of perpetuity bonds in dollar (sample answer: $25,000 ) will you want to hold to both fully fund and immunize your obligation? Suppose you buy 1-year zero-coupon bonds and perpetuity bonds to immunize your obligation. Now suppose that rates immediately increase to 9%. e. What is your tuition obligation now? (sample answer: $25,000) f. What is the value of your position in 1-year-zero-coupon bonds now ? (sample answer: $25,000) g. What is the value of your position in perpetuity now ? (sample answer: $25,000)

Step by Step Solution

There are 3 Steps involved in it

To solve this problem well go through each part step by step a Present Value of Your Obligation To f... View full answer

Get step-by-step solutions from verified subject matter experts