Question: You will be completing the accounting cycle for one month for a merchandising company. That means you will prepare financial statements for a one month

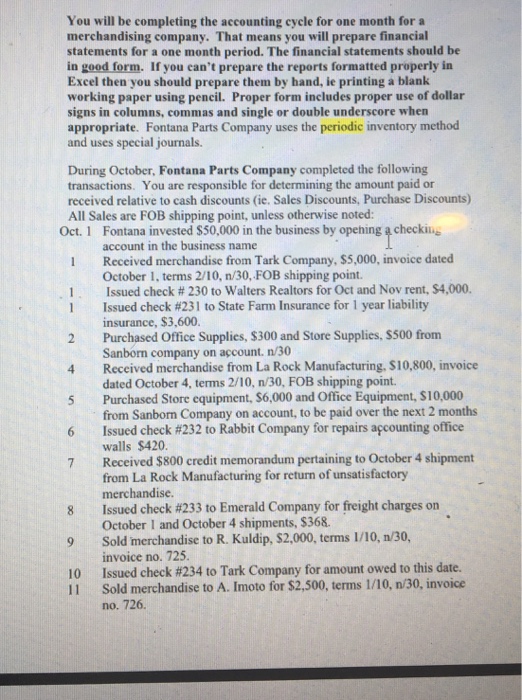

You will be completing the accounting cycle for one month for a merchandising company. That means you will prepare financial statements for a one month period. The financial statements should be in good form. If you can't prepare the reports formatted properly in Excel then you should prepare them by hand, ie printing a blank working paper using pencil. Proper form includes proper use of dollar signs in columns, commas and single or double underscore when appropriate. Fontana Parts Company uses the periodic inventory method and uses special journals. During October, Fontana Parts Company completed the following transactions. You are responsible for determining the amount paid or received relative to cash discounts (ie. Sales Discounts, Purchase Discounts) All Sales are FOB shipping point, unless otherwise noted: Fontana invested $50,000 in the business by opening a checku. account in the business name Received merchandise from Tark Company, $5,000, invoice dated October 1, terms 2/10, n/30, FOB shipping point. Issued check # 230 to Walters Realtors for Oct and Nov rent, S4.000. Issued check #231 to State Farm Insurance for 1 year liability insurance, $3,600. Purchased Office Supplies, $300 and Store Supplies, $500 from Sanborn company on account. n/30 Received merchandise from La Rock Manufacturing, $10,800, invoice dated October 4, terms 2/10, n/30, FOB shipping point. Purchased Store equipment, S6,000 and Office Equipment, $10,000 from Sanborn Company on account, to be paid over the next 2 months Issued check #232 to Rabbit Company for repairs afcounting office walls $420. Received $800 credit memorandum pertaining to October 4 shipment from La Rock Manufacturing for return of unsatisfactory merchandise. Oct. 1 1 1 1 2 4 5 7 8 Issued check #233 to Emerald Company for freight charges on 9 Sold merchandise to R. Kuldip, $2,000, terms 1/10, n/30, 10 Issued check #234 to Tank Company for amount owed to this date. October I and October 4 shipments, $368. invoice no. 725. Sold merchandise to A. Imoto for $2,500, terms 1/10, n/30, invoice no. 726. 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts