Question: you will be given three errors that may or may not affect the trial balance. You are to determine the following: 1. As a

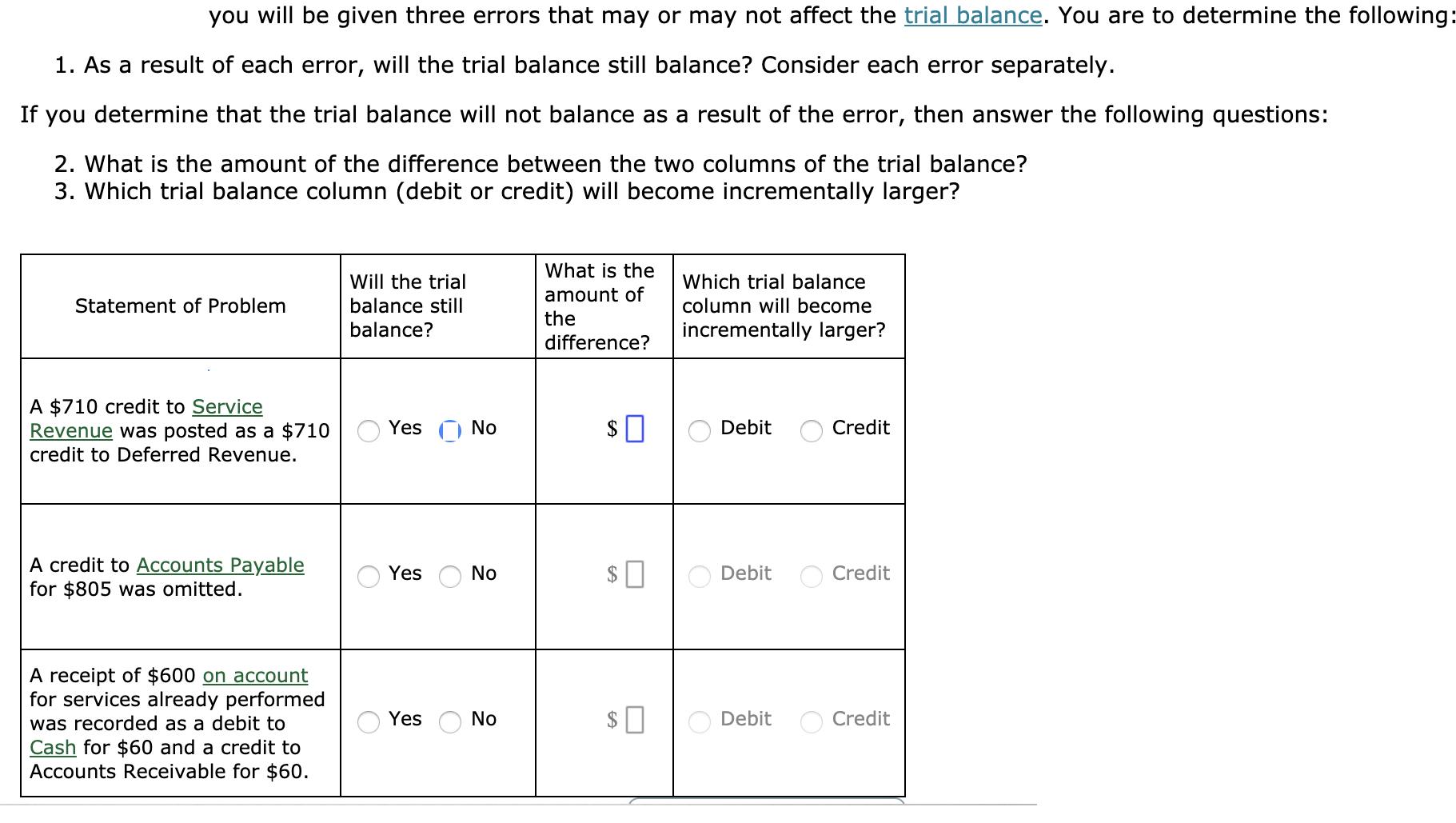

you will be given three errors that may or may not affect the trial balance. You are to determine the following: 1. As a result of each error, will the trial balance still balance? Consider each error separately. If you determine that the trial balance will not balance as a result of the error, then answer the following questions: 2. What is the amount of the difference between the two columns of the trial balance? 3. Which trial balance column (debit or credit) will become incrementally larger? Statement of Problem A $710 credit to Service Revenue was posted as a $710 credit to Deferred Revenue. A credit to Accounts Payable for $805 was omitted. A receipt of $600 on account for services already performed was recorded as a debit to Cash for $60 and a credit to Accounts Receivable for $60. Will the trial balance still balance? Yes Yes Yes O No No No What is the amount of the difference? $0 $0 $0 Which trial balance column will become incrementally larger? Debit Debit Debit Credit Credit Credit

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

1 As a result of the error where a 710 credit to Service Revenue was posted as a 710 credit to Defer... View full answer

Get step-by-step solutions from verified subject matter experts