Question: you will be voted according to your given Answer, Find out the gross annual value in the following cases for the AY 2019-20 Particulars Situated

you will be voted according to your given Answer,

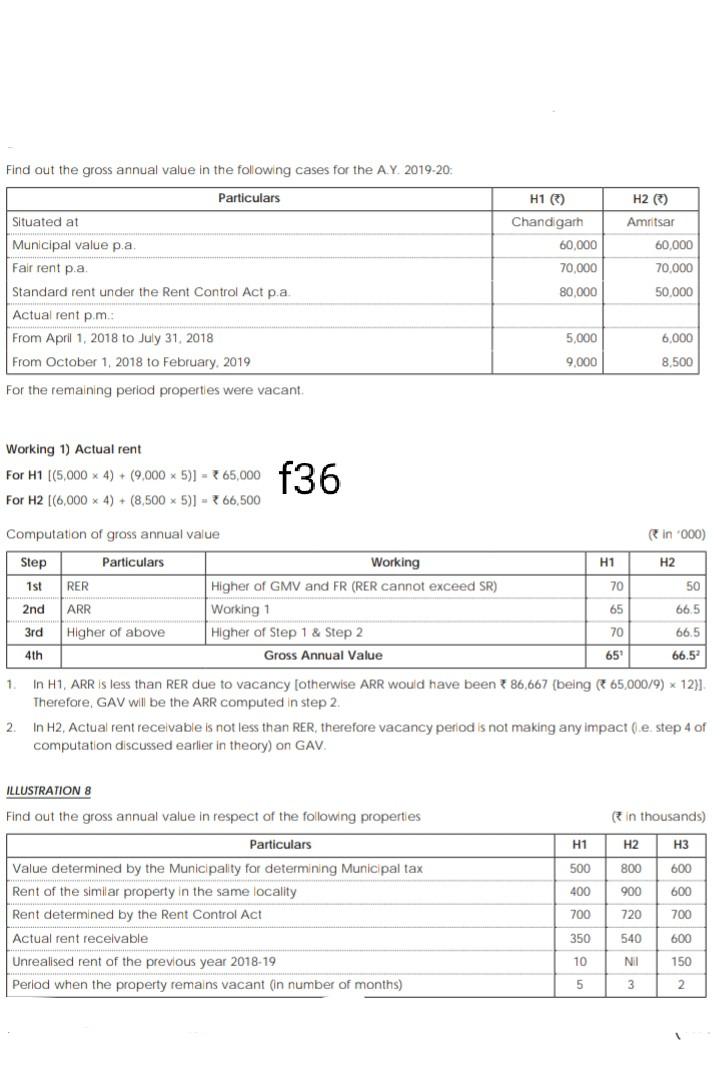

Find out the gross annual value in the following cases for the AY 2019-20 Particulars Situated at H1 () Chandigarh 60,000 70,000 80,000 H2 (6) Amritsar 60.000 70,000 50.000 Municipal value p.a Fair rent p.a. Standard rent under the Rent Control Act p.a Actual rent pm: From April 1, 2018 to July 31, 2018 From October 1, 2018 to February, 2019 For the remaining period properties were vacant. 5,000 6,000 9,000 8.500 Working 1) Actual rent For H1 (5,000 x 4) + (9.000 5)] = 65,000 For H2 (6,000 x 4) + (8,500 x 5)] = 66,500 f36 Computation of gross annual value in '000) Step Particulars Working H1 H2 1st RER Higher of GMV and FR (RER cannot exceed SR) 70 50 2nd ARR Working 1 65 66.5 3rd Higher of above Higher of Step 1 & Step 2 70 66.5 4th Gross Annual Value 650 66.5 In H1, ARR is less than RER due to vacancy (otherwise ARR would have been 86,667 [being 65,000/9) x 12)] Therefore, GAV will be the ARR computed in step 2 In H2, Actual rent receivable is not less than RER, therefore vacancy period is not making any impact (e step 4 of computation discussed earlier in theory) on GAV 1 1 2 ILLUSTRATION 8 H1 500 (in thousands) H2 H3 800 600 900 600 Find out the gross annual value in respect of the following properties Particulars Value determined by the Municipality for determining Municipal tax Rent of the similar property in the same locality Rent determined by the Rent Control Act Actual rent receivable Unrealised rent of the previous year 2018-19 Period when the property remains vacant (in number of months) 400 700 720 700 350 540 600 150 NI 10 5 3 2Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock