Question: you will be voted according to your given Answer thank such other expenses including services as cannot conveniently be charged direct ot specific cost units.

you will be voted according to your given Answer thank

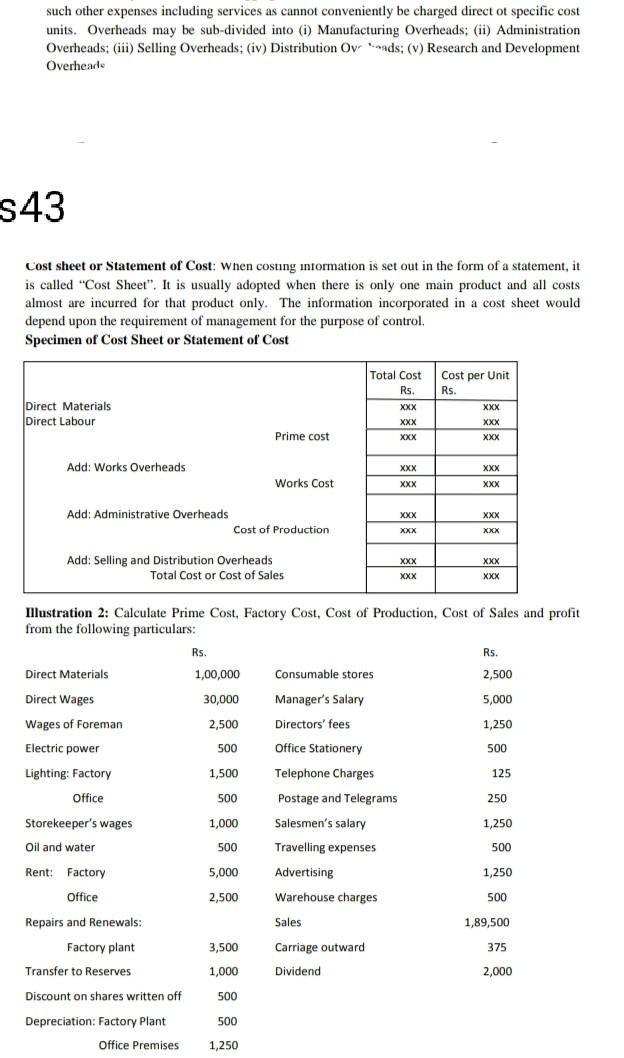

such other expenses including services as cannot conveniently be charged direct ot specific cost units. Overheads may be sub-divided into (i) Manufacturing Overheads: (ii) Administration Overheads: (iii) Selling Overheads; (iv) Distribution Ovr ads: () Research and Development Overheade S43 Cost sheet or Statement of Cost: When costing information is set out in the form of a statement, it is called "Cost Sheet". It is usually adopted when there is only one main product and all costs almost are incurred for that product only. The information incorporated in a cost sheet would depend upon the requirement of management for the purpose of control, Specimen of Cost Sheet or Statement of Cost Total Cost Cost per Unit Rs. Rs. XXX Direct Materials Direct Labour XXX XXX XXX XXX Prime cost XXX Add: Works Overheads : XXX XXX XXX Works Cost XXX XXX XXX Add: Administrative Overheads Cost of Production XXN XXX XXX XXX Add: Selling and Distribution Overheads Total Cost or Cost of Sales XXX XXX Illustration 2: Calculate Prime Cost, Factory Cost, Cost of Production, Cost of Sales and profit from the following particulars: Rs. Rs. Direct Materials 1,00,000 Consumable stores 2,500 Direct Wages 30,000 Manager's Salary 5,000 Wages of Foreman 2,500 Directors' fees 1,250 Electric power 500 Office Stationery 500 Lighting: Factory 1,500 Telephone Charges 125 Office 500 Postage and Telegrams 250 Storekeeper's wages 1,000 Salesmen's salary 1,250 Oil and water 500 Travelling expenses 500 Rent: Factory 5,000 1,250 Advertising Warehouse charges Office 2,500 500 Sales 1,89,500 Repairs and Renewals: Factory plant Transfer to Reserves 375 3,500 1,000 Carriage outward Dividend 2,000 Discount on shares written off 500 Depreciation: Factory Plant 500 Office Premises 1,250 such other expenses including services as cannot conveniently be charged direct ot specific cost units. Overheads may be sub-divided into (i) Manufacturing Overheads: (ii) Administration Overheads: (iii) Selling Overheads; (iv) Distribution Ovr ads: () Research and Development Overheade S43 Cost sheet or Statement of Cost: When costing information is set out in the form of a statement, it is called "Cost Sheet". It is usually adopted when there is only one main product and all costs almost are incurred for that product only. The information incorporated in a cost sheet would depend upon the requirement of management for the purpose of control, Specimen of Cost Sheet or Statement of Cost Total Cost Cost per Unit Rs. Rs. XXX Direct Materials Direct Labour XXX XXX XXX XXX Prime cost XXX Add: Works Overheads : XXX XXX XXX Works Cost XXX XXX XXX Add: Administrative Overheads Cost of Production XXN XXX XXX XXX Add: Selling and Distribution Overheads Total Cost or Cost of Sales XXX XXX Illustration 2: Calculate Prime Cost, Factory Cost, Cost of Production, Cost of Sales and profit from the following particulars: Rs. Rs. Direct Materials 1,00,000 Consumable stores 2,500 Direct Wages 30,000 Manager's Salary 5,000 Wages of Foreman 2,500 Directors' fees 1,250 Electric power 500 Office Stationery 500 Lighting: Factory 1,500 Telephone Charges 125 Office 500 Postage and Telegrams 250 Storekeeper's wages 1,000 Salesmen's salary 1,250 Oil and water 500 Travelling expenses 500 Rent: Factory 5,000 1,250 Advertising Warehouse charges Office 2,500 500 Sales 1,89,500 Repairs and Renewals: Factory plant Transfer to Reserves 375 3,500 1,000 Carriage outward Dividend 2,000 Discount on shares written off 500 Depreciation: Factory Plant 500 Office Premises 1,250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts