Question: You will create a worksheet called Cash Flows in Excel and use it to calculate the items in the financial or free cash flow framework

You will create a worksheet called "Cash Flows in Excel and use it to calculate the items in the financial or free cash flow framework for Nike, Inc. using the below Income Statement, Balance Sheet, and Cash Flow Statements.

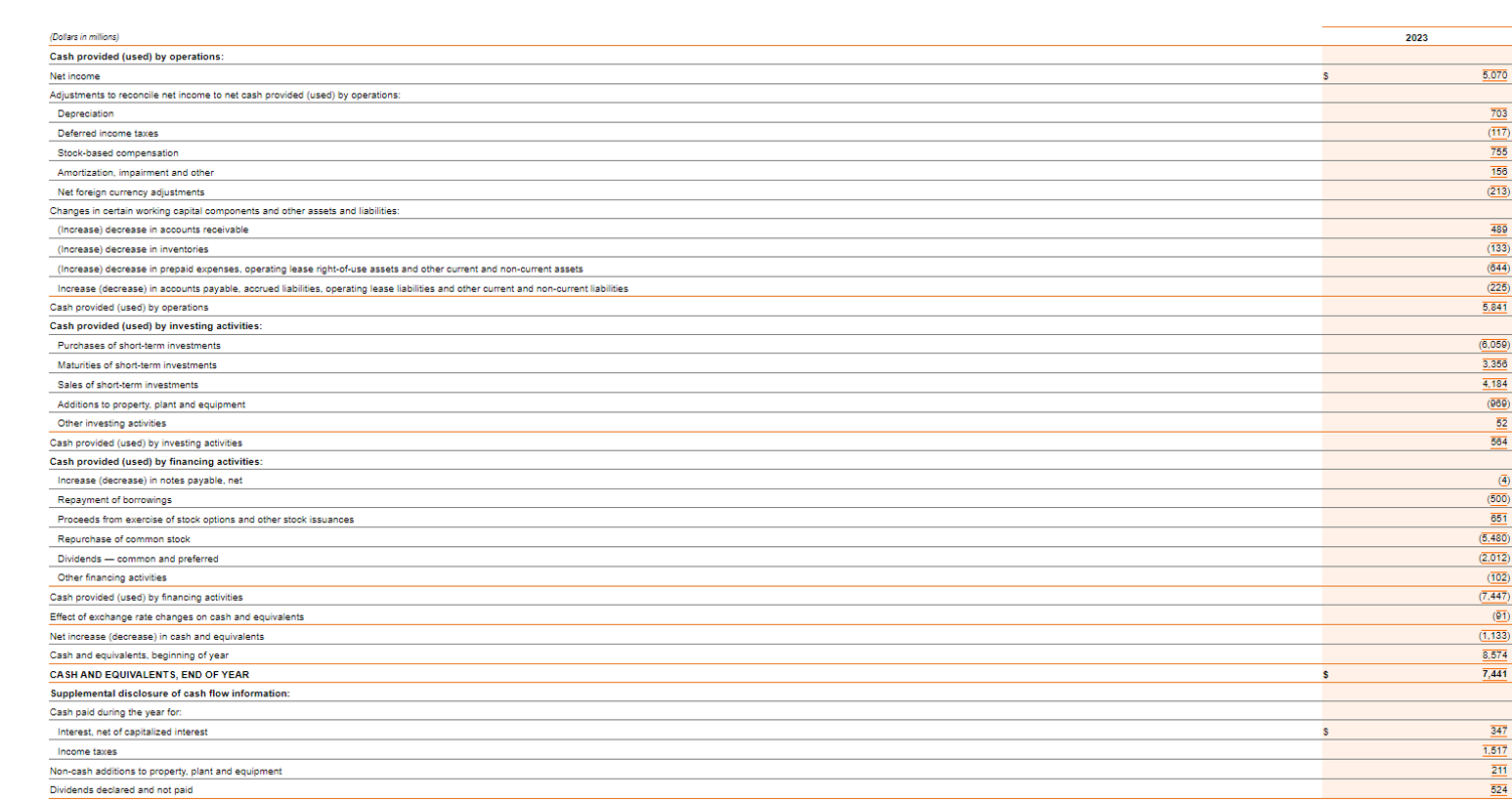

In your worksheet, attempt to construct a statement of financial cash flows (free cash flow = cash flow - creditors + cash flow- stockholders). You may look at the standard indirect or accounting cash flow statement for additional information. You may use the change in debt categories in place of debt issued minus debt retired. Assume that deferred long-term liability charges represent deferred tax liabilities.

Show all 3 parts (free cash flow, CF-creditors, CF-stockholders), and fill in as much detail as you can. Comments or notes on your calculations are welcome. Calculate each of the 3 parts directly. For example, solve for cash flow to shareholders using its determinants; dont back into cash flow to shareholders (free cash flow minus cash flow to creditors).

CONSOLIDATED STATEMENT OF CASH FLOWS

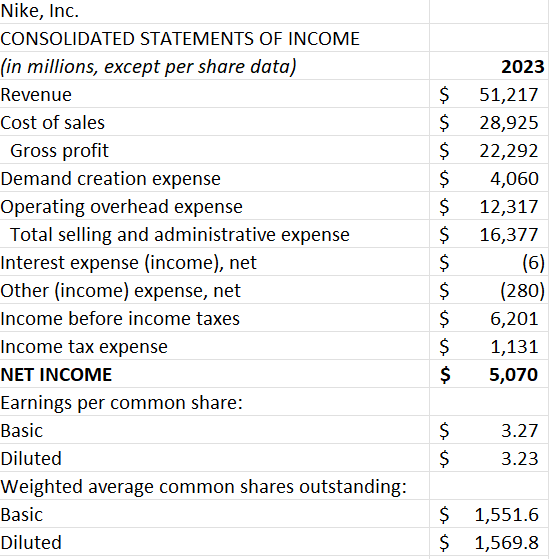

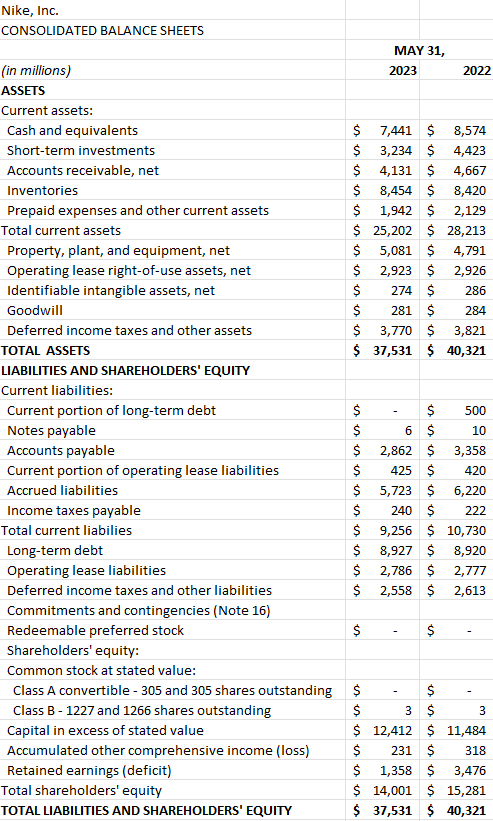

Nike, Inc. CONSOLIDATED STATEMENTS OF INCOME \begin{tabular}{l|rr} (in millions, except per share data) & & 2023 \\ Revenue & $ & 51,217 \\ Cost of sales & $ & 28,925 \\ \hline Gross profit & $ & 22,292 \\ \hline Demand creation expense & $ & 4,060 \\ Operating overhead expense & $ & 12,317 \\ \hline Total selling and administrative expense & $ & 16,377 \\ Interest expense (income), net & $ & (6) \\ \hline Other (income) expense, net & $ & (280) \\ Income before income taxes & $ & 6,201 \\ \hline Income tax expense & $ & 1,131 \\ \hline NET INcomE & $ & 5,070 \\ \hline Earnings per common share: & & \\ Basic & $ & 3.27 \\ \hline Diluted & $ & 3.23 \\ \hline Weighted average common shares outstanding: & & \\ Basic & $ & 1,551.6 \\ Diluted & $ & 1,569.8 \end{tabular} Nike, Inc. CONSOLIDATED BALANCE SHEETS Nike, Inc. CONSOLIDATED STATEMENTS OF INCOME \begin{tabular}{l|rr} (in millions, except per share data) & & 2023 \\ Revenue & $ & 51,217 \\ Cost of sales & $ & 28,925 \\ \hline Gross profit & $ & 22,292 \\ \hline Demand creation expense & $ & 4,060 \\ Operating overhead expense & $ & 12,317 \\ \hline Total selling and administrative expense & $ & 16,377 \\ Interest expense (income), net & $ & (6) \\ \hline Other (income) expense, net & $ & (280) \\ Income before income taxes & $ & 6,201 \\ \hline Income tax expense & $ & 1,131 \\ \hline NET INcomE & $ & 5,070 \\ \hline Earnings per common share: & & \\ Basic & $ & 3.27 \\ \hline Diluted & $ & 3.23 \\ \hline Weighted average common shares outstanding: & & \\ Basic & $ & 1,551.6 \\ Diluted & $ & 1,569.8 \end{tabular} Nike, Inc. CONSOLIDATED BALANCE SHEETS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts