Question: You will create an Excel application that allows a user to compare purchasing three different homes at different terms and interest rates. To complete this

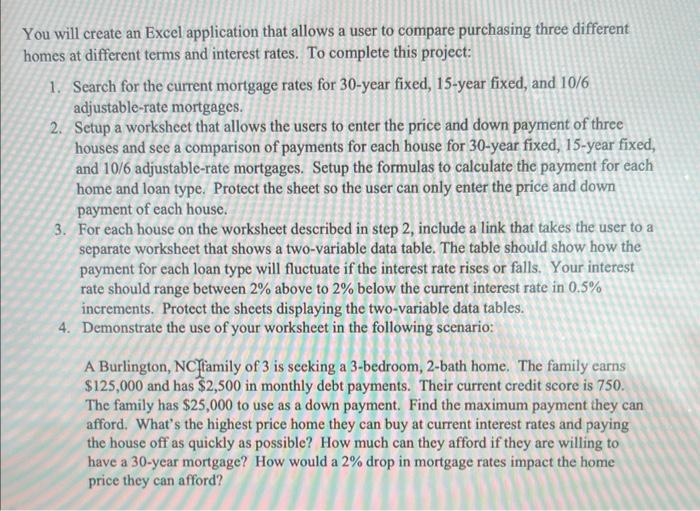

You will create an Excel application that allows a user to compare purchasing three different homes at different terms and interest rates. To complete this project: 1. Search for the current mortgage rates for 30 -year fixed, 15-year fixed, and 10/6 adjustable-rate mortgages. 2. Setup a worksheet that allows the users to enter the price and down payment of three houses and see a comparison of payments for each house for 30 -year fixed, 15-year fixed, and 10/6 adjustable-rate mortgages. Setup the formulas to calculate the payment for each home and loan type. Protect the sheet so the user can only enter the price and down payment of each house. 3. For each house on the worksheet described in step 2, include a link that takes the user to a separate worksheet that shows a two-variable data table. The table should show how the payment for each loan type will fluctuate if the interest rate rises or falls. Your interest rate should range between 2% above to 2% below the current interest rate in 0.5% increments. Protect the sheets displaying the two-variable data tables. 4. Demonstrate the use of your worksheet in the following scenario: A Burlington, NCffamily of 3 is seeking a 3-bedroom, 2-bath home. The family earns $125,000 and has $2,500 in monthly debt payments. Their current credit score is 750 . The family has $25,000 to use as a down payment. Find the maximum payment they can afford. What's the highest price home they can buy at current interest rates and paying the house off as quickly as possible? How much can they afford if they are willing to have a 30-year mortgage? How would a 2% drop in mortgage rates impact the home price they can afford? You will create an Excel application that allows a user to compare purchasing three different homes at different terms and interest rates. To complete this project: 1. Search for the current mortgage rates for 30 -year fixed, 15-year fixed, and 10/6 adjustable-rate mortgages. 2. Setup a worksheet that allows the users to enter the price and down payment of three houses and see a comparison of payments for each house for 30 -year fixed, 15-year fixed, and 10/6 adjustable-rate mortgages. Setup the formulas to calculate the payment for each home and loan type. Protect the sheet so the user can only enter the price and down payment of each house. 3. For each house on the worksheet described in step 2, include a link that takes the user to a separate worksheet that shows a two-variable data table. The table should show how the payment for each loan type will fluctuate if the interest rate rises or falls. Your interest rate should range between 2% above to 2% below the current interest rate in 0.5% increments. Protect the sheets displaying the two-variable data tables. 4. Demonstrate the use of your worksheet in the following scenario: A Burlington, NCffamily of 3 is seeking a 3-bedroom, 2-bath home. The family earns $125,000 and has $2,500 in monthly debt payments. Their current credit score is 750 . The family has $25,000 to use as a down payment. Find the maximum payment they can afford. What's the highest price home they can buy at current interest rates and paying the house off as quickly as possible? How much can they afford if they are willing to have a 30-year mortgage? How would a 2% drop in mortgage rates impact the home price they can afford

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts