Question: you will have two case studies to complete. Both will involve completing a consolidation worksheet for two companies whose statements need to be consolidated. The

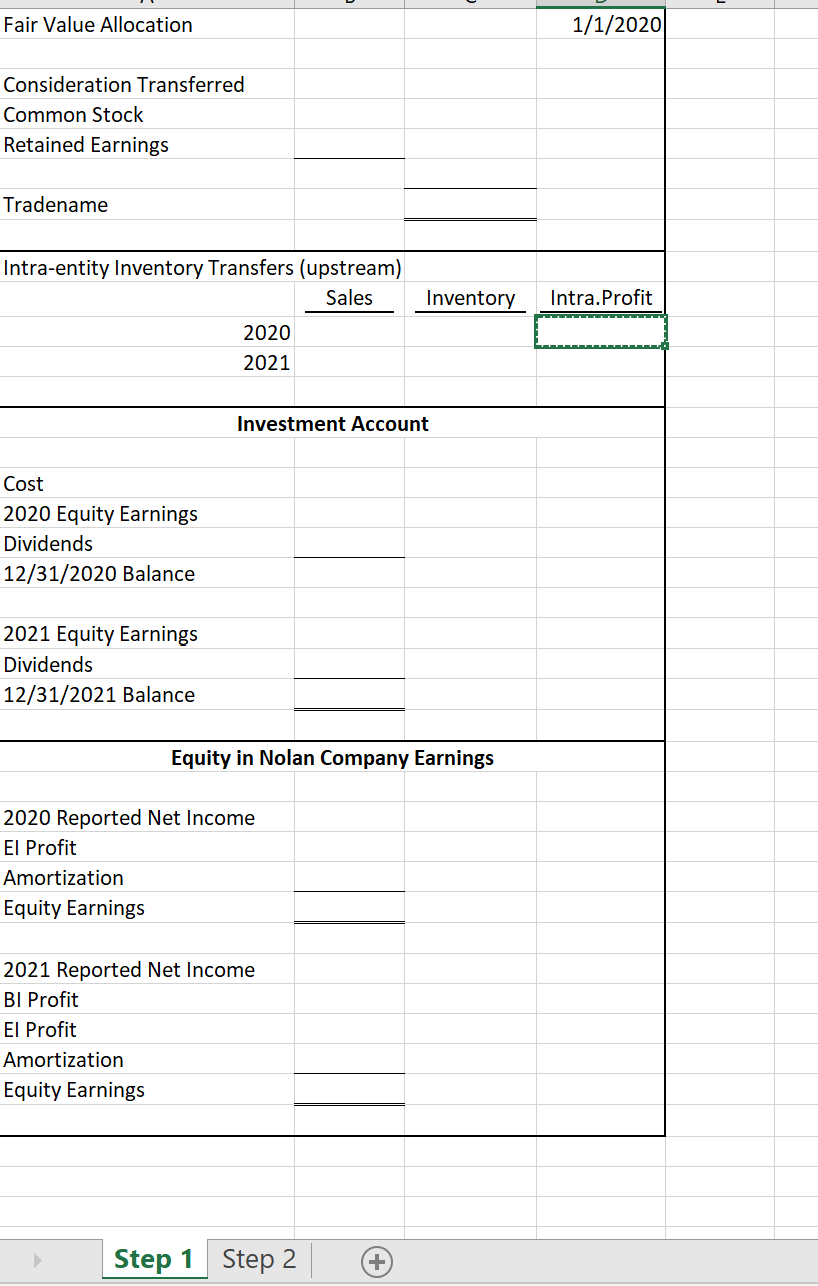

you will have two case studies to complete. Both will involve completing a consolidation worksheet for two companies whose statements need to be consolidated. The first case will be due in Week ?The second case will involve IntraEntity Asset Transactions and will be due at the end of Week Case Study ?Due Week On January ?Innovus, Inc., acquired ?percent of the common stock of ChipTech Company for $ ?in cash and other fairvalue consideration. ChipTech's fair value was allocated among its net assets as follows:Case ?Image The December ?trial balances for the parent and subsidiary follow there were no intraentity payables on that date:Case ?Image Using Excel, compute consolidated balances for Innovus and ChipTech by completing the provided worksheet. The Excel Template can be accessed by clicking this linkLinks to an external site..?Case Study ?Due Week ?On January ?James Company purchased ?percent of the outstanding voting stock of Nolan, Inc., for $ ?in cash and other consideration. At the purchase date, Nolan had common stock of $ ?and retained earnings of $ ?James attributed the excess of acquisitiondate fair value over Nolan's book value to a trade name with an estimated year remaining useful life. James uses the equity method to account for its investment in Nolan.During the next two years, Nolan reported the following:Case ?Image Nolan sells inventory to James after a markup based on a gross profit rate. At the end of ?and ?percent of the current year purchases remain in James's inventory.Using the attached Excel template, compute the following:The Equity Method balance in James' Investment in Nolan, Inc., account as of December Worksheet adjustments for the December ?adjustments of James and Nolan. Use the following Codes to designate the purpose of the journal entry:Journal Entry LegendFormulate your solution so that Nolan's gross profit rate on sales to James is treated as a variable.

Fair Value Allocation Consideration Transferred Common Stock Retained Earnings Tradename 1/1/2020 Intra-entity Inventory Transfers (upstream) Cost 2020 Equity Earnings Dividends 12/31/2020 Balance Sales Inventory Intra.Profit 2020 2021 Investment Account 2021 Equity Earnings Dividends 12/31/2021 Balance Equity in Nolan Company Earnings 2020 Reported Net Income El Profit Amortization Equity Earnings 2021 Reported Net Income BI Profit El Profit Amortization Equity Earnings Step 1 Step 2 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts